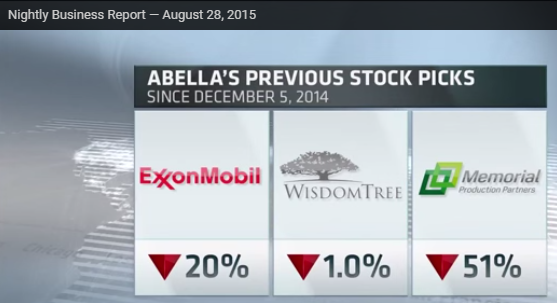

The S&P 500 (SPY) has lost 4.2% since these picks.Source: Nightly Business Report

Portfolio manager Gregg Abella of Investment Partners Asset Management was placed in the uncomfortable position of having to explain these picks he recommended almost nine months ago. His over-weighting in oil really hurt. Abella is also the analyst who brought Memorial Production Partners (MEMP) to my attention. It was a pick that worked wonderfully for my first trade and then very poorly on my second and current trip. I was hoping Nightly Business Report would bring Abella back for an update, so this segment was quite timely.

A little to my surprise, Abella is STILL recommending MEMP. Sometimes these money managers get on the show and say they already exited a major loser. Unfortunately, Abella was not given much time to explain himself. He only had the following to say:

“The price target from analysts is still roughly at the same level as the last time I was on. It trades in line with oil, but it is one of the most rigorously hedged master limited partnerships [MLPs] in this space, and it pays a really nice cash distribution. That distribution is currently at 17%. [Price target is $13.31].”

This rationale is almost an exact repeat from last time. I wanted to hear Abella say more about MEMP’s decline beyond the tie to oil prices. He did not acknowledge the dividend cut or what has to be current fears of more cuts to come. That juicy 17% is probably too big to last. Finally, Abella needed to explain why a “rigorously hedged” MLP would drop so much.

On the positive side, at least Abella is sticking with MEMP as any good value investor would who is convinced of the fundamentals.

MEMP has probably made a major low alongside oil. MEMP opened at $5 to start the week and ended the week at $7.21. That is a near 50% gain from end-to-end! Oil gained 12% on the week for its first weekly gain in about two months. I was not thinking to buy my third (and final) tranche in the middle of this churn. I was actually profiting from other opportunities this past week.

Leave A Comment