Well, former FX trader Richard Breslow is right about one thing: there’s been no shortage of hyperbole used to describe what we’ve seen in DM rates over the past couple of weeks.

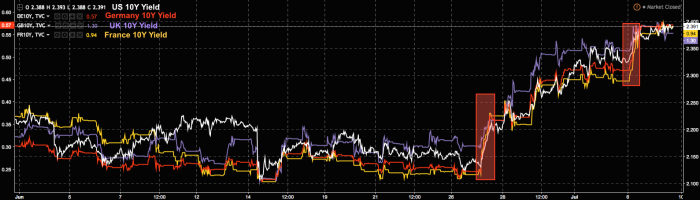

[Note: those red highlights represent, in order, Draghi kicking off a parade of hawkishness by saying he’s going to “look through” purportedly “transitory” weakness in the incoming inflation data, and the sudden selloff in bunds that was triggered by a weak 30Y auction in France on Thursday]

“Rout,” “tantrum,” “debacle,” – all words that been variously ascribed to what you see in that chart.

And honestly, I don’t know what else you would call it. It is a “rout”. It is a “tantrum” (at least in bunds, if we’re sticking to the definition of “tantrum” as we defined it the last time bund yields surged like they have over the last two weeks). And depending on who you are, it is a “debacle.”

So while Breslow may be wrong to say those adjectives are “a bunch of tripe,” he’s probably correct to say that we’re looking at things wrong.

We’ve all been conditioned to look at markets through the eyes of carry traders, corporate management teams leveraging their balance sheets to buy back shares, etc. In short: we’ve all been conditioned to look at things like we’ve been forced to look at them for the last eight years.

Ultimately, that’s not healthy and here’s Breslow to explain why…

Via Bloomberg

Leave A Comment