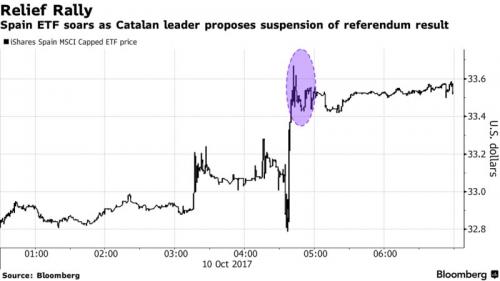

S&P 500 futures point to a slightly lower open, as Asian stocks rise to trade near decade highs, with Japan’s Nikkei 225 closing at highest since 1996. European stocks are little changed, with Spanish shares gaining after Catalan President rows back from an immediate declaration of independence. MSCI’s all-world stocks index briefly hit a fresh record high in opening European trading as a 1.5% jump in Spain’s IBEX added to a 10-year high set by Asian shares overnight.

In early trading, the euro extended gains spurred by Catalonia’s pullback from an immediate declaration of independence from Spain, while the dollar drifted as investors awaited minutes from the last Federal Reserve meeting. Spanish stocks ralied sharply, with the IBEX 35 index rising as much as 2%, helped by a rise in banking shares which rallied as much as 4%, after Catalan President Carles Puigdemont said he’ll seek talks with Madrid over the future of his region in Spain delaying any independence announcement for “weeks”, rowing back from an immediate declaration of independence.

“There was a chance Puigdemont would have made a decisive declaration, so now yields are dropping because there is room for negotiation left,” said DZ Bank strategist Christian Lenk.

At the same time, the Spanish 10y bond yield dropped 5bps to 1.65%. However, shortly before 5am ET, the EURUSD slumped without a specific catalyst, while the European rally fizzled modestly as renewed fears over the fate of the Catalan region re-emerged. Puigdemont’s backtrack averted an immediate confrontation over independence for Catalonia, though Spanish leaders are maintaining a hard line. Deputy Prime Minister Soraya Saenz de Santamaria accused Puigdemont of irresponsible leadership even as he sought to reassure companies fleeing the region. Prime Minister Rajoy convened an extraordinary meeting of his cabinet in Madrid on Wednesday to discuss his next move.

Elsewhere in Europe, the FTSE 100 climbed to as high as 7,550.17, surpassing its record closing level of 7547.63, after rising steadily the past 3 weeks. However, the index was down fractionally at last check. The pound has been under pressure in the past month as Brexit negotiations remain stuck on questions over the divorce terms, such as the size of the U.K.’s exit payments and the future of EU citizens’ rights. Stocks elsewhere on the continent, however, struggled for traction, with the Stoxx Europe 600 gauge flat as a drop in industrial metals led miners lower.

Asian equity markets were mostly positive as the region got a tailwind from Wall Street where all 3 major indices posted fresh all-time highs. This supported sentiment with ASX 200 (+0.6%) also lifted by energy names after WTI reclaimed the USD 51/bbl level to the upside. Shanghai Comp. (+0.2%) and Hang Seng (-0.4%) were choppy after a feeble liquidity effort by the PBoC and with Hong Kong benchmark just about kept afloat amid Chief Executive Lam’s policy address and profit tax cut announcement.

The most notable overnight move was the jump in Japanese shares, with the Nikkei 225 closing at its highest since December 1996, propped by companies in industries ranging from technology to retail. Machinery maker Fanuc Corp., Recruit Holdings Co., FamilyMart UNY Holdings Co., SoftBank Group Corp. and Terumo Corp. were the biggest contributors to the Nikkei 225’s gain, while scandal-whipped Kobe Steel Ltd. was the worst performer, falling a record 36 percent over two sessions. Railway companies and insurers propelled the benchmark Topix index to a decade-high for a second straight day.

“Expectations for upward revisions in local companies’ annual profit targets are pretty high ahead of the earnings season kicking off later this month,” said Yoshihiro Ito, chief strategist at Okasan Online Securities Co. in Tokyo. “It also reflects anticipation of a victory for the Abe administration in the upcoming election.”

Japan’s stock market has been buoyed by a series of upbeat economic data. A Cabinet Office report released before the market opened Wednesday showed Japan’s core machinery orders for August climbed more than analysts expected. The yen’s weakness against the dollar has further fanned speculation for robust growth in quarterly earnings. Japanese voters will head to the polls on Oct. 22 for a general election in which Prime Minister Shinzo Abe’s Liberal Democratic Party will be challenged by Tokyo Governor Yuriko Koike’s new Party of Hope. Support for the LDP was up marginally to 31.2 percent in an opinion survey conducted Oct. 7-9, compared with a poll from last week, according to public broadcaster NHK.

In the US, President Donald Trump’s public feud with Tennessee Senator Bob Corker, an influential fellow Republican, has raised concern that his push for a tax-code overhaul could be harmed. At the same time, the Federal Reserve will publish the minutes from its last minute later with a third U.S. rate hike of the year now looking nailed on for December.

“Squabbles surrounding Trump’s efforts come as no surprise, but it is still not helping the dollar,” said Yukio Izhizuki, senior currency strategist at Daiwa Securities in Tokyo.

Overnight, Trump tweeted dismisses rumours that Chief of Staff Kelly will be fired soon, in which he blames dishonest media and says the chief is doing a fantastic job. Elswhere, Fed’s Kaplan (voter, soft hawk) said will be assessing progress of US economy towards full employment and looking for more signs of upward inflation. Kaplan added that he is mindful waiting too long to raise rates could leave the Fed behind the curve and increases chances of a recession, but also commented that the Fed can afford to be patient on rate hikes because economic growth is not running away. US may seek stricter NAFTA rules of origin and may require 85% of content to come from 3 NAFTA countries, may also seek 50% US content requirement, according to reports.

In FX, most Asian emerging currencies were higher after China fixed the yuan stronger and as news on Catalonia encouraged risk-taking, while concerns over U.S. tax reform and geopolitical risks lingered. Taiwan’s dollar was the biggest gainer, followed by Thailand’s baht while the offshore yuan fell. The euro rose to the highest level in two weeks after Catalan President Carles Puigdemont said that while an Oct. 1 referendum had given him the mandate to pursue independence, he would “suspend” the result for some weeks for dialogue with Spanish Prime Minister Mariano Rajoy’s administration. Catalan concerns have been rolled over to a future date and the yuan has been stronger, which are among the positive factors for Asia’s emerging currencies, said Stephen Innes, Singapore-based head of trading for Asia Pacific at Oanda Corp.

Leave A Comment