Today I used Barchart to sort the S&P 600 Small Cap Index stocks to find the stocks with technical buy signals of 80% or better and a Weighted Alpha of 50.00+. The top stocks today were The Medicines Company (NASDAQ:MDCO), Dycom Industries (NYSE:DY), Central Garden & Pet (NASDAQ:CENTA), Virtusa (NASDAQ:VRTU), and LHC Group (NASDAQ:LHCG).

The Medicines Company

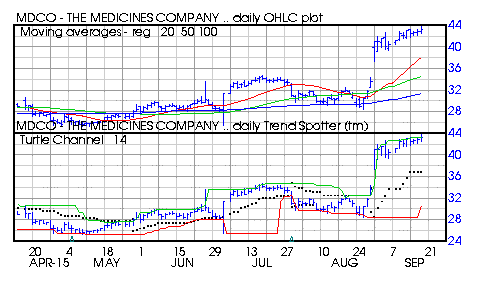

Barchart technical indicators:

96% Barchart technical buy signals

95.35+ Weighted Alpha

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

10 new highs and up 38.77% in the last month

Relative Strength Index 74.46%

Barchart computes a technical support level at 41.52

Recently traded at 43.31 with a 50 day moving average of 34.51

Dycom Industries

Barchart technical indicators:

96% Barchart technical buy signals

153.62+ Weighted Alpha

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

10 new highs and up 15.49% in the last month

Relative Strength Index 70.06%

Barchart computes a technical support level at 76.55

Recently traded at 79.32 with a 50 day moving average of 68.48

Central Garden & Pet

Barchart technical indicators:

96% Barchart technical buy signals

112.63+ Weighted Alpha

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

9 new highs and up 31.17% in the last month

Relative Strength Index 83.18%

Barchart computes a technical support level at 14.94

Recently traded at 16.20 with a 50 day moving average of 12.14

Virtusa

Barchart technical indicators:

88% Barchart technical buy signals

51.12+ Weighted Alpha

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

9 new highs and up 7.31% in the last month

Relative Strength Index 60.25%

Barchart computes a technical support level at 52.53

Recently trade at 53.38 with a 50 day moving average of 50.54

LHC Group

Barchart technical indicators:

Leave A Comment