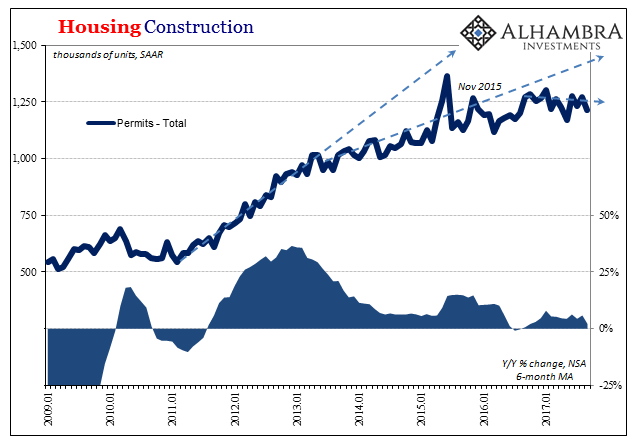

Housing construction continues to slow in 2017, dragged down by fewer multi-family projects. Total permits and starts have essentially flatlined since 2015, a further slowdown from one already slowdown. The single-family market is still growing but at a historically tepid pace, leaving the pace of construction overall to be dictated by weakness in apartment development.

In September 2017, new permits for multi-family structures dropped on a seasonally-adjusted basis to 360k from a significantly revised (downward) 436k in August. The 6-month average, a better measure smoothing out very high monthly variations in this series, has been less than 400k for each of the past five months. At the most recent peak, the average was 481k in July 2015.

That change in direction corresponds very closely with the slowdown in the labor market indicated by even the Establishment Survey’s headline payroll numbers. The BLS estimates that the labor market really started to decelerate in early 2015 after the first wave of “rising dollar” effects surprised many. That slowdown was only further amplified by the near-recession that resulted from those effects, one that has yet to be positively corrected despite more than a year and a half since.

The equation in housing from there is quite simple – fewer new jobs, fewer new housing units. The possibility that the labor market has retraced back to 2012 levels (or more, depending on your view of how much the BLS may have overstated labor gains in 2014) certainly fits with weakness in single-family construction (as well as reluctant potential resellers) and now deepening reluctance to risk new apartment construction.

The decline in new starts is particularly compelling in that regard. As my colleague Joe Calhoun always says, anyone can file a permit but starting a project requires real effort and therefore is indicative of market intent. Seasonally-adjusted, new multi-family starts were just 286k in September (with the caveat of both monthly revisions from that preliminary figure, as well as annual benchmark revisions released with next month’s update), along with September 2016’s 265k the lowest going back to 2012-13. In other words, the lower trend since the end of last year is becoming quite serious.

Leave A Comment