What is it that’s different in August? If there was some relative calm in global markets in June and July it certainly disappeared this month. The dollar shot higher and global liquidity indications began sinking again. Yields have fallen on safety (liquidity) instruments more apparently divorced from any other mainstream factors.

One place to look for answers is Tokyo. I wrote at the beginning of July during what seemed like a lull:

It doesn’t mean, however, Japan is out altogether. Far from it. Japanese banks are still in the eurodollar business and tied to China. Like some mafia family organization, once you are in there is no getting out, at least not all the way. They can cut back and turn off some of their activities but not all of them. There is still very much a “dollar” redistribution business running through Tokyo.

That would be, for me, one indication of moving deeper into the red at least as I sketched out these reflation/deflation cycles last week. If JPY were to suddenly and sharply move inversely to CNY, it might propose those kinds of self-reinforcing behaviors that are down at the worst of things.

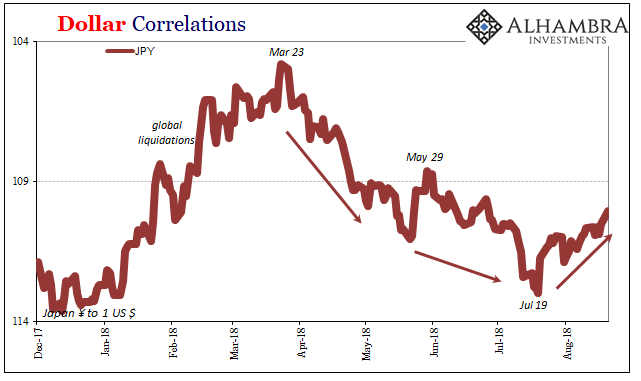

Inverse to CNY would mean, obviously, JPY rising as CNY falls. Sure enough, here’s JPY since mid-July:

More and more it appears that the period between May 29 and the middle or end of July was not really one of calm so much as re-assessment. The rethinking seems to have been about what that was on May 29 and what it might mean for beyond the short run. We see May 29 show up practically everywhere, not just in bunds yields.

One of the more prominent reversals has been inflation trading. Breakevens derived from the TIPS market display a crystal-clear inflection in those specific days between when the UST selloff reached its recent high (yield) and that collateral event two weeks later. In terms of the 5s breakevens, it’s about as prominent of a rolling over signal as you might ever see.

Leave A Comment