Stocks Continue To Be Volatile

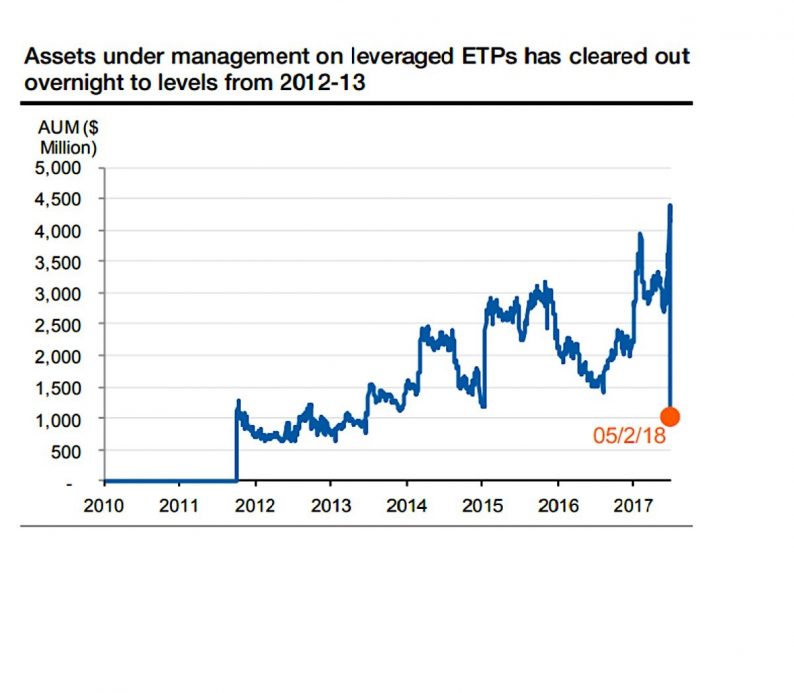

I’m almost willing to say we’re entering a new normal where swings occur more often. Technically, that normal is how equities have existed throughout history besides the last two years. If the increasing interest rates caused the volatility, it could be here to stay. If it was caused by the volatility ETPs, it will be over after this week. As you can see from the chart below, the assets under management on leveraged ETPs has fallen sharply from about $4.5 billion to about $1 billion. The trading vehicles, which started to become prominent in 2012, look like they’re being eliminated. The end of the business cycle is when the most absurd trends and decisions are made. When the cycle ends, we’ll see what other crazy actions were going on. From a psychological perspective, the thought process goes from ‘what could go wrong?’ to ‘what will go wrong?’ I knew the VIX short position was overcrowded, but figuring out that it would unwind in February was impossible.

Since the leveraged ETPs have now cleared out, this latest volatility is related to fundamental changes in the market, namely the increase in bond yields. The stock market had a volatile day on Wednesday as the S&P 500 closed down 0.5% after being up 1.2% at one point in the day. This was the sharpest reversal since February 2016. The Dow was up 381 points at one point and fell as much as 127 points before closing down 19 points. This was the sharpest reversal since August 2015. As I mentioned, if the yields increase along with stocks falling, it likely means the rising interest rates are the problem since the volatility derivative indexes are done. The 10 year bond yield hit the problematic point that hurt stocks last week as it increased about 3 basis points on Wednesday to 2.8359%.

High Yield Bonds Also Selling Off

Interestingly, the VIX was down 7.51% to 27.73 on Wednesday even though stocks fell. This is a reversal of earlier this year when stocks rose along with the VIX. If the 10 year bond yield being above 2.8% can break the VIX, this is a problem because it will likely go above 3% in the next few months. Even though I discussed in a previous post that the volatility was centered around stocks, it appears there has been some weakness in the high yield bond market. As you can see from the chart below, the high yield options adjusted spread is spiking. If you zoom this chart out, this movement will look small, but all trends need to start somewhere. It appears a new risk off trade is blossoming with increasing rates being the catalyst of this.

Leave A Comment