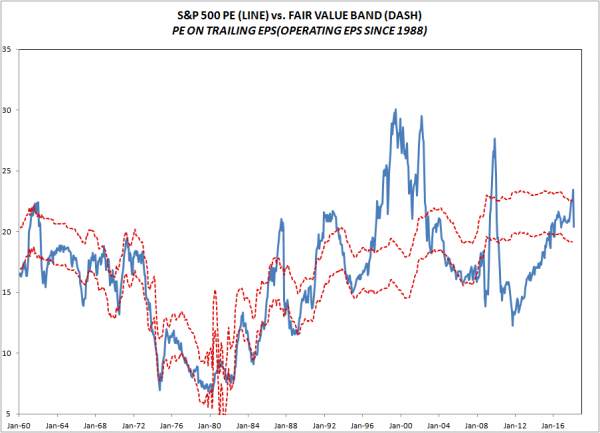

With the market falling like it did over the past week it may prove valuable to look at the PE and some other economic reports. In my PE model the market became overvalued in December and January. The last observation is at the market close on Thursday, 8 February 2018. the previous two observation are the end of December and January values.

Notice that the PE did not rise until December. As of November 2017 the market PE was still below where it was when Trump was elected. If the market rallied because investors expected higher future earnings because of the tax cut, it did not show up in the PE until the tax bill was actually passed. The usual rule is to buy the rumor and sell the fact. But given Trump’s record, it was understandable that investors were not willing to pay up for stronger earnings until the legislation was actually signed into law.

Most of the market rally for a year after Trump was elected reflected double-digit earnings growth rather than a higher PE as investors started discounting stronger earnings. Now, we have a divergence in earnings expectations as the top down strategists and economist expect the tax cut to generate double-digit earnings growth in 2018. But the bottoms-up analysts only expect modest earnings gains. Analysts expectations are driven largely by company guidance. This divergence may suggest that corporate America is not as bullish as Wall Street has been the last few months.

Generally ignored because of the jobs report, productivity was reported the same day as unemployment, and it was very weak. As a consequence, the spread between unit labor cost and prices — the nonfarm deflator– narrowed sharply. This spread is the dominate determine of profit margins and is a leading to concurrent indicator of earnings growth. It implies that earnings growth will be quite weak over the next few months. Right now there seems to be two views on 2018 profits growth. Economists and strategist expect the tax cut to lead to double-digit earnings growth in 2018 while analysts expect single digit earnings growth. Analysts bottoms-up forecast are driven largely by management guidance. So this divergence between analyst and economists may imply that corporate management may not be as bullish on the economy as Wall Street.

Leave A Comment