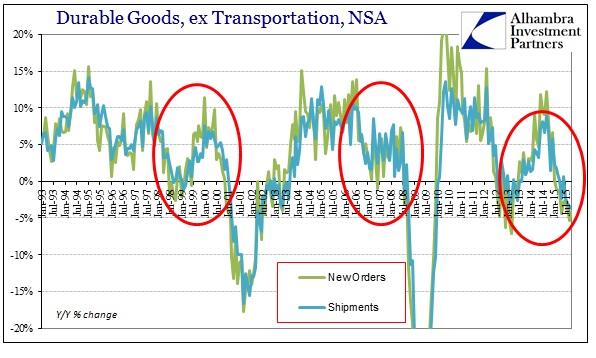

Durable goods orders and shipments were estimated still consistent with the depressive environment that has “unexpectedly” lingered for the whole of 2015. Year-over-year, new orders for durable goods fell 4.13% while shipments contracted by 3.74%. That is the ninth straight decline in orders and the fourth in shipments (and five out of the last six months). The 6-month averages in both are now below the prior cycle lows that showed up in the 2012 slowdown – that precipitated QE3 and then QE4.

The ugliness extends still to capital goods orders and shipments, even though cap goods orders were better in October than September and August; new orders for capital goods declined only 1.23% in October after falling 5.03% and 7.17% in the prior two months. Still, capital goods orders have dropped in every month this year while shipments are just now starting to catch up to that. The 6-month average for capital goods shipments is now negative while the average for orders remains at less than -4%.

This contraction is persistent and accumulating while extending to “both” sides of the economic ledger – consumers and business capex. That suggests a serious weakness in economic circulation in the most efficient manner possible.

And still this is treated as if some sort of novelty, as if there aren’t any other economic accounts that confirm the possible exhaustion of consumers at the same time as horrible business condition. The unemployment rate is positively robust while GDP, if uneven and unstable, is still within the confines of the “meh” that has dominated since 2009. But those are distant data point: instead, retail sales continue to be plain awful and recessionary in their own right, and further consumers have suddenly begun to borrow this year just for that reproachable level. As far as businesses, consumer spending is revenue and we just so happen to find a large and growing depression on that count:

Leave A Comment