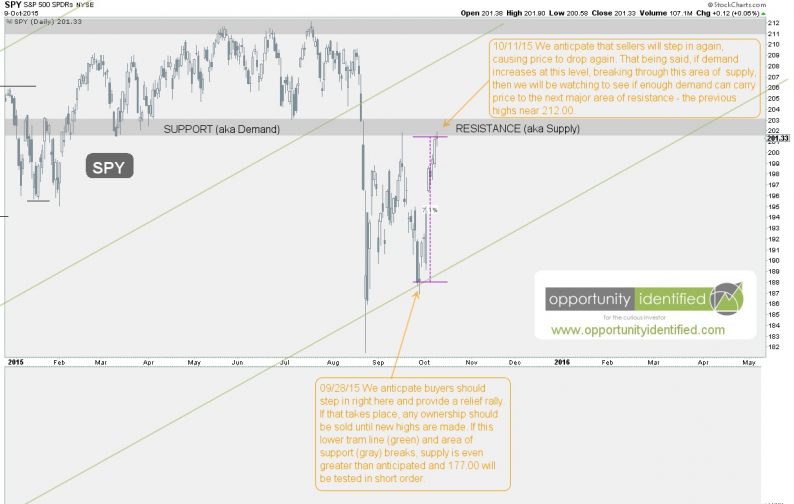

Back on September 28th, we took a look at the S&P 500 (SPY) and shared the following with our readers:

We anticipate buyers should step in right here and provide a relief rally. If that takes place, any ownership should be sold until new highs are made.

9 trading days and +7% later, here we are with another update. And again, we are at an important juncture. After anticipating this rip-your-face-off rally, we’ve reached a level of resistance that is worth watching. As you might remember, price is simply the interaction of supply and demand. More demand than supply, price goes up. More supply than demand, price goes down. This is economic law. Price moves to equilibrium — where there is a balance between supply and demand — until one outbalances the other and a new equilibrium must be discovered. In liquid markets, such as the S&P 500, this is an ongoing and fluid process.

As we study price (aka technical analysis), we can identify those areas where supply (selling) and demand (buying) are greatest just by watching price itself. As of Friday’s closing price, the S&P 500 (using ETF SPY as our proxy), has hit an area of resistance we find significant. In the past, the 201-203 area was an area of support, where buyers would step in and send price upward. This characteristic changed on August 21st, when SPY dropped through this important level without buyers stepping in. Using the chart from September 28, let’s zoom in a bit so you can see what we’re referring to:

We see price is currently up against an area of resistance. Looking left , we find this area of resistance was previously an area of support, where buyers stepped in to create demand. But on August 21st, this changed. On that date, there were not enough buyers to keep price from descending through this level. Accordingly, this area of support became an area of resistance, which was confirmed on September 17th, when increasing prices were met with significant supply (selling) at the 202 level, sending price downward in search of new demand.

Leave A Comment