(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 9.3%

T2107 Status: 12.9% (a fresh near 7-year closing low)

VIX Status: 26.1% (high of the day was 27.6, right under the 2012 intraday high

General (Short-term) Trading Call: bullish

Active T2108 periods: Day #8 under 20%, Day #11 under 30%, Day #27 under 40%, Day #31 below 50%, Day #46 under 60%, Day #387 under 70%

Commentary

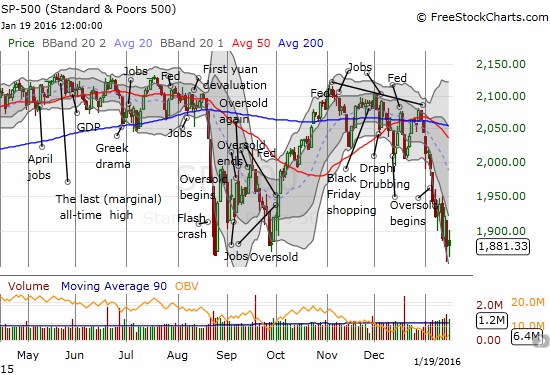

T2108 closed at 9.3% on day #8 of this oversold period. Traders positioning for the next (relief) rally have been holding their collective noses for a third day now as the trading action continues to stink – to use a technical term. Three out of the last four trading days have ended with T2108 in single digits. Using holding their collective noses, this scenario suggests that this oversold period could reach for a 15-day span…just in time for the next meeting of the Federal Reserve.

While T2108 closed with a marginal gain, the S&P 500 (SPY) struggled mightily to close flat yesterday. I am not calling this a bullish divergence because the change in T2108 is so small relative to the size of this bearish trading action.

The S&P 500 (SPY) is struggling mightily to hold support from the August Angst.

As the reality of an extended oversold period has sunk into my consciousness, I pulled the trigger on precious few trades. So now comes the time for waiting: I am waiting for a signal from the volatility index, the VIX. The last element of the T2108 trading rules is to make a move once volatility “spikes.” Given my current aggressive positioning, it makes little sense to continue accumulating until the nature of trading changes in my favor. A spike in the VIX could and should signal the imminent end of this oversold period.

Leave A Comment