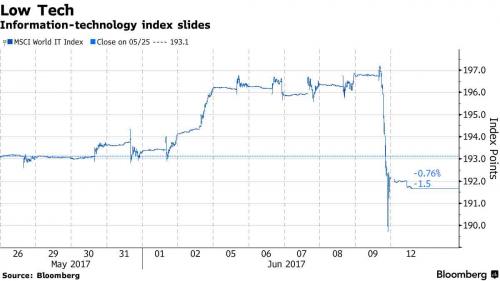

First the bad news: following Friday’s “tech wreck” European equity markets have opened lower, with the Stoxx 600 sliding 0.9% and back under the 50DMA for the first time since December, dragged by selloff in tech shares, mirroring Asian markets as Friday’s “FAAMG” volatility in U.S. markets spreads globally, battering shares from South Korea to the Netherlands. European banks lag as the Spanish regulator stepped in to prevent another bank collapse, this time of LiberBank which we profiled yesterday, by banning short-selling in the regional commercial bank to mitigate Popular-related contagion.

Samsung Electronics, ASML Holding and Tencent Holdings led declines in Europe and Asia, dragging down benchmark indexes according to Bloomberg. U.S. stock futures, which ignored Friday’s tech move, also fell as markets continue to digest the Nasdaq 100’s plunge on Friday. Europe’s tech index fell as much as 2.8% to put it on track for its biggest one-day loss since October. The index had reached a 15-year high earlier this month and has soared around 40 percent over the last year

As discussed over the weekend, the sudden slide in tech stocks, which was responsible for nearly half the YTD gains in the S&P helped send global equities to repeated record levels this year, blindsided many investors after markets largely brushed aside last week’s trio of risk events. The question now, according to BBG, is whether the drops represent merely a pause or a more fundamental crack in the U.S. stock bull market.

“There’s a chance U.S. internet technology stocks that have propelled a global stock rally will now serve as a buzz kill,” said Mitsuo Shimizu, deputy general manager at Japan Asia Securities in Tokyo.

In an ominous note over the weekend, Goldman warned that “The Last Time The Market Acted Like This Was At The Tech Bubble Peak” suggesting more pain may be in store for tech stocks.

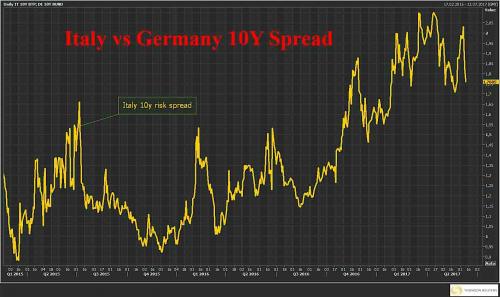

Now the good news: Italian BTPs rally from the open, with the spread to bunds tightening 6bps due to poor performance from populist party in Italian local election, further reducing chances of early national elections. It spurred on debt markets. Italian government bond yields fell to their lowest since January.”Macron doing well in the first round of the French parliamentary elections bodes well for him getting a majority,” said Lyn Graham-Taylor, fixed income strategist at Rabobank. “The fact that 5-Star did poorly in local elections in Italy also suggests a setback for populism in Europe.”

A similar reaction was observed in French bonds, where the spread to Bunds has dropped to 36 bps after yesterday’s landslide victory for Macron’s party in the first round of the French presidential election.

In other key moves, the USD/JPY has broken back below 110.00 as USD weakens, AUD/USD also supported by overnight rally in iron ore futures +2.6%. The short sterling strip bull flattens, with cable finally cracking below 1.27 after some initial support as markets continue to re-evaluate political certainty and Brexit implications of U.K. election.

Meanwhile, the Washington drama continues, with reports over the weekend that AG Jeff Sessions offered to speak to the Senate Intelligence Committee to answer questions about alleged Russian meddling in the 2016 presidential election. On Wednesday the Federal Reserve is set to lift rates, leading a pack of central banks that are mostly nodding in the direction of removing ultra-accommodative policy.

The euro rose back to $1.1225 in the currency markets before fading modestly, where anticipation is also building ahead of Wednesday’s conclusion of a two-day FOMC meeting. The central bank is widely expected to nudge up U.S. interest rates by another quarter point, but economists will be watching to see whether the recent dip in economic data and wave of uncertainty surround Donald Truump has weighed on confidence.

Britain’s sterling also remained in focus as it began to backslide again. It was hovering at $1.2730 and 88.08 pence per euro as Prime Minister Theresa May attempted to prop up her position after her party’s last week’s damaging election. “The political risks are mounting,” said Kathleen Brooks, head of research with City Index in London.

In commodities, crude oil prices extended gains after rising on Friday when a pipeline leak in major producer Nigeria overshadowed supply worries weighing on the market. U.S. crude and Brent were both 0.6 percent higher at $46.10 and $48.45 a barrel, respectively, while copper rose for a fourth straight session and gold XAU= snapped a three-day losing streak to climb to 1,269 an ounce

Bulletin Headline Summary from RanSquawk

Market Snapshot

Key Overnight Headlines

Leave A Comment