Over the last several weeks, I have discussed the markets entrance into the

“Seasonally Weak” period of the year and the breakout of the market above the downtrend line that began last year.

The rally from the February lows, driven by a tremendous amount of short covering, once again ignited

“bullish optimism.”

“Canaccord Genuity’s Tony Dwyer estimates the equity benchmark will end 2017 at 2,340, an increase of 15 percent from Wednesday’s closing level of 2,047.63, with half of the gains coming this year.”

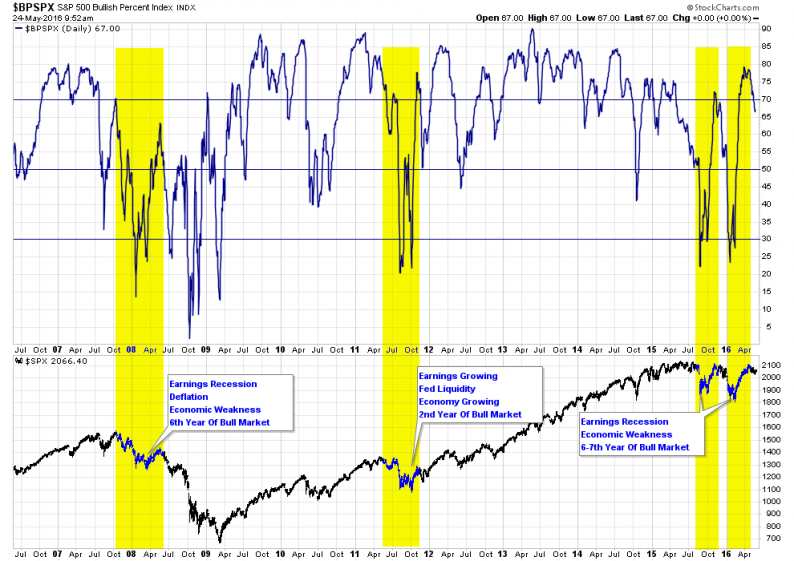

But it is not just Tony that is buying into the “optimistic” story, but investors also as the number of stocks on “bullish buy signals” has exploded since the February lows.

While the “bulls” are quick to point out the current rebound much resembles that of 2011, I have made notes of the differences between 2011 and 2008. The reality is the current market set up is more closely aligned with the early stages of a bear market reversal.

It is the last point that I want to follow up with this week.

There is little argument that the bulls are clearly in charge of the market currently as the rally from the recent lows has been quite astonishing. However, as I noted recently, the current rally looks extremely similar to that seen following last summer’s swoon.

Well, here we are once again entering into the “seasonally weak” period of the year. Will the bullish hopes prevail? Maybe. But.

Warning Signs Everywhere

Many have pointed to the recent correction as a repeat of the 2011 “debt ceiling default” crisis. Of course, the real issue in 2011 was the economic impact of the Japanese tsunami/earthquake/meltdown trifecta, combined with the absence of liquidity support following the end of QE-2, which led to a sharp drop in economic activity. While many might suggest that the current environment is similar, there is a marked difference.

Leave A Comment