When I write about the F.A.N.G. names I oftentimes get mixed reactions. Many of my readers are of the conservative, income-oriented variety. They’re nearing retirement and have little to no desire to associate themselves with names/acronyms so closely associated with speculative growth.

Being that none of the F.A.N.G. names currently play a shareholder dividend, I can’t blame investors who require a certain yield threshold from their investments for showing disinterest in these companies that don’t meet their investment goals.

If this is the investing mindset that you typically adhere to, I’ll forewarn you now, this article is going to be of little interest to you…

However, there are two groups of readers who I think will benefit from reading this piece: the younger investors who follow my work with very long time horizons ahead of them in the markets and those individuals who hear F.A.N.G. and simply turn up their noises, as if these companies and all of the hype that surrounds them is nothing more than a scam driven by market hysteria and Jim Cramer’s histrionics.

Although I consider myself to be a dividend growth investor, I have exposure to a handful of non-dividend paying names. This was the discussion of my last piece here at Sure Dividend and the editors have asked me to follow up with this piece, focusing on the famous (or notorious, depending on which side of the fence you find yourself on) F.A.N.G. names.

Back in 2013, Jim Cramer began hyping the F.A.N.G. names after his colleague at RealMoney.com, Bob Lang, came up with the nickname for the four biggest growth stocks of the time: Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google (GOOG) (which has since changed its name to Alphabet). Here’s what I believe to be the original article breaking down the F.A.N.G. names. Say what you will about Cramer, but he certainly nailed this call.

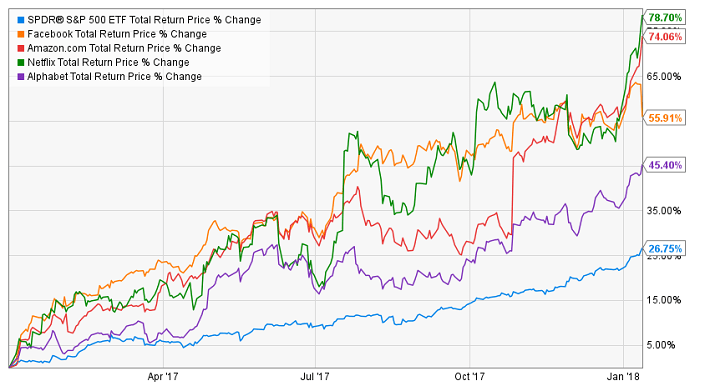

Let’s take a look at F.A.N.G.’s massive outperformance over the last 12 months. If you thought the broader indexes went on a run during 2017 then you’ll be taken aback by F.A.N.G.’s performance.

Although I’ve been an owner of several of these names for awhile now (admittedly, I didn’t get behind the theme as early as Mr. Booyah himself). With that said, I was still surprised by the extent of their relative out performance during the past year or so. First of all, I never expect 40-50% total return in any 12-month period. Those expectations are just outlandish, regardless of the growth potential of a holding. What’s more, 2017 was supposed to be the year of the Trump Rally, meaning financials and industries were set to soar, not the big names from Silicon Valley whose social and political stances tend to lean left. With a couple of exceptions, Silicon Valley wasn’t a friendly place for President Trump during the election and I think the F.A.N.G.’s out performance during the first year under a changing (and theoretically less-friendly regime) speaks volumes about the strong secular trends driving the growth of these names.

But even more impressive than their 2017 returns are the 5-year returns produced by the F.A.N.G. names. As you can see below, anyone holding these stocks has done quite well for themselves since Mr. Lang and Mr. Cramer created the F.A.N.G. bandwagon.

As I said in my prior piece here at Sure Dividend, after deciding to pursue a DGI strategy, it took years for me to diversify away from the traditional domestic dividend growers. I view my willingness to expand my horizons into international markets, as well as into non-dividend paying growth stocks when looking for growth, as a sign of maturity as a portfolio manager.

I got pretty good at identifying DGI names that were trading at fair value or better. My returns early on were great using a basic DGI, buy and hold approach Looking at my results alongside many of the other DGI success stories that I’ve been told, I have no doubt that this is a fine strategy for investors seeking financial freedom. However, as solid as my returns were in the market, they were not F.A.N.G.-like.

I saw the massive runs that these big tech names were going on and the competitor in me wanted a piece of that action. For so long, I avoided the temptation to buy into these high growth names. I did my best to stick to the conservative roots that had been treating me so well.

I bought into the mindset that these “fabulous F.A.N.G.” stocks were massively overpriced and highly speculative assets. I used their valuation as an excuse to protect myself from the thin resentment that I tried to ignore when I spoke to others who had bought a ticket to the F.A.N.G. ride and were having an amazing time.

“I’ll wait for a pullback,” I said to myself.

Well, this waiting game went on for years and I eventually realized that the market wasn’t the irrational one, it was me. I was letting the conservative, DGI dogma that I had cut my teeth on as a young investor get in the way of probably the best opportunity for long-term wealth creation that the market had in store for me.

I didn’t closely follow any of the F.A.N.G. names back in 2013 when the acronym was coined, but I wouldn’t be surprised if they all weren’t highly speculative on a fundamental basis at the time. The digital revolution as we know it today was just getting started and I don’t think anyone had an accurate idea of just how powerful and disruptive these digital/mobile business models would be. However, flash forward to early 2016 when I began buying some of these names and their businesses had matured. Not only had they developed extraordinarily wide moats in growth industries with long runways ahead of them, but they had developed envious cash flows as well.

So, let’s start breaking down these companies individually. I’ll also be discussing the speculative likelihood of shareholder returns (and especially dividends) when looking at the fundamentals, because while income is far from the forefront of my mind when looking at my F.A.N.G. exposure, I also wouldn’t be totally surprised if 50 years from now, several, if not all of these four companies have evolved into dividend aristocrats.

When I did my year-end portfolio overview, Facebook comprised 1.91% of my portfolio, which was almost enough to allow it to crack my top 10 holdings (Facebook was my 11th largest position, behind Johnson and Johnson’s 1.97% weighting). Facebook is my second largest F.A.N.G. position, behind Alphabet. I’ve built such a large Facebook position because of the intriguing valuation that I find here.

Leave A Comment