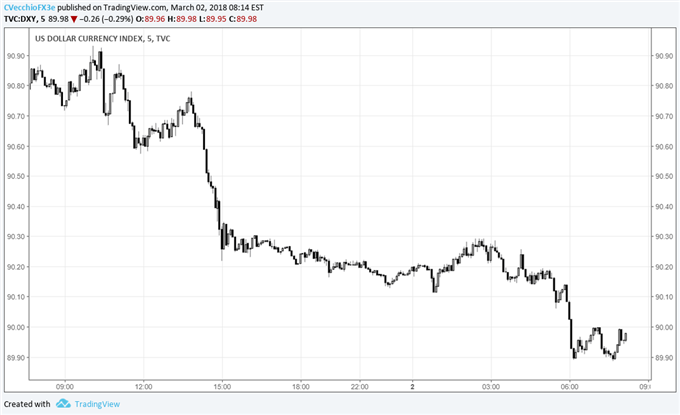

US President Donald Trump shocked global markets yesterday by announcing his intention to introduce a 25% tariff on imported steel and a 10% tariff on imported aluminum. The US Dollar was slammed across the board alongside US equity markets amid fears of trade wars emerging. It’s important for traders to understand the economic significance of tariffs and how they impact economies.

Price Chart 1: DXY Index 5-minute Timeframe (March 1 to 2, 2018)

To no surprise, US steel and aluminum industry insiders are a fan of the 25% and 10% tariffs that US, respectively. As is often the case with protectionist tariffs, prices for goods using steel and aluminum will rise for the entire economy while these insiders will capture the surplus. In this piece, we’ll go in some historical examples of tariffs and their ensuing impacts.

Generally speaking, tariffs are “good in theory,” but “terrible in practice.” The theory is, “protect domestic industries,” but in practice, it means “enriching a small segment at the expense of the broader economy.” Adam Smith espoused this point in A Wealth of Nations, John Meynard Keynes in The General Theory of Unemployment, and empirical data collected over the past 400 years suggests the same conclusion…but I digress.

PROTECTIONIST TARIFFS LEAD TO BIAS, ARTIFICE, AND CORRUPTION

There are three main takeaways why protectionism via tariffs/limiting free trade is bad:

1) Protectionism always ends up with a bias because it serves to protect “domestic producers in competition with foreign producers.” This means protectionist policies like a tariff favor industries in competition with foreign manufacturers over those that are not.

For example, tariffs on imported manufactured goods might be good for domestic US manufacturers, but they’ll be bad for anyone else, particularly US agriculture or US service jobs who are not in competition with foreign producers.

Leave A Comment