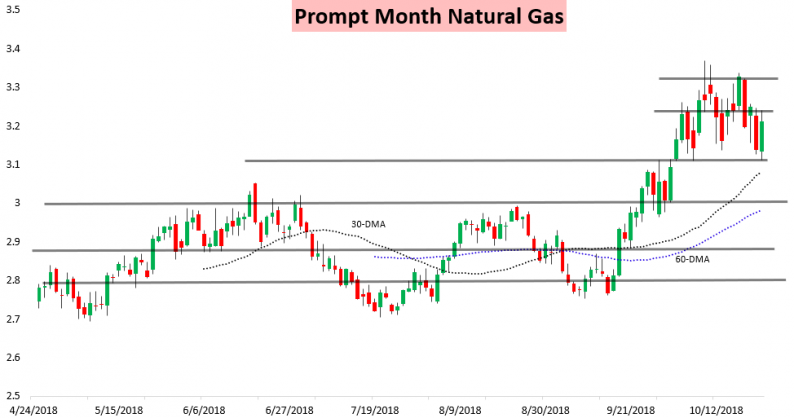

It’s been a wild few days in the natural gas market, with prices selling off then reversing higher Friday, only to then set new lows yesterday on warmer long-range weather models before strong physical prices and more mixed long-range weather forecasts helped prices cancel out almost all of yesterday’s losses today.

A significant winter premium was added back along the strip today as the November contract saw the largest gain with its expiry next Monday approaching but the rest of the winter strip saw support as well.

This came after we saw large selling yesterday that fit with our expectations from last Friday, when we warned clients that long-range models were likely to increase warm risks into Monday.

Yesterday’s Morning Update furthered the trend too, emphasizing that we see “at least $3.1 in play” because “long range warm risks are finally increasing…”

We didn’t quite get to $3.11 overnight, instead tagging $3.111 before prices began shooting higher. Strong cash prices certainly played a role in the rally today.

Concerns about low storage levels seemed to increase with the G/H February/March contract spread moving out to new wide levels as well.

Today’s rally came despite more mixed GWDD forecasts, and afternoon Climate Prediction Center forecasts actually increased warm risks across the Southeast in the long-range.

Still, it is clear low storage levels are spooking the natural gas market, and cold weather over the next few days is doing little to help.

Leave A Comment