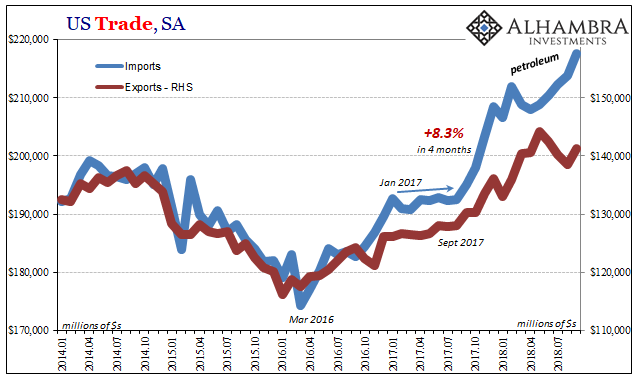

US imports rose sharply (seasonally-adjusted) in September 2018 over August. Both with and without petroleum, the year-over-year gains (unadjusted) were about 9%. September, however, will be the last month of favorable comparisons. Over the next few months, last year’s artificial hurricane-related surge will move into the base for comparisons.

Exports were up far more modestly, still down from the trade war peak in May.

US demand in 2018 has been unusually tepid. Imports including petroleum have increased by just 4.3% (seasonally-adjusted) since last December. That’s an annual rate of just less than 6%, a lackluster result for a year that is supposed to be booming. Excluding oil prices and petroleum, imports are up only 2.7% on the year. That 3.6% annual rate is closer to recession level demand than anything else.

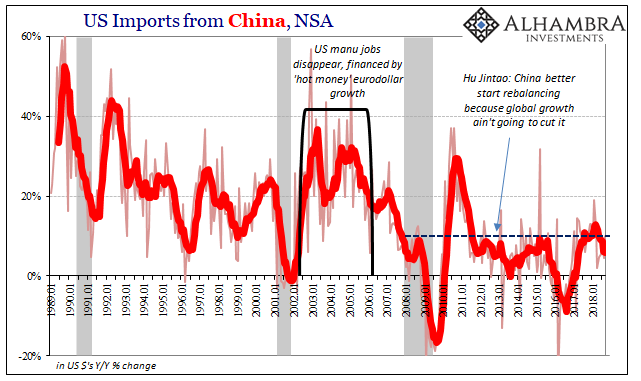

That’s certainly the view from China. For the month of September, Chinese imports rose 10.1% from the same month last year. It is the first double-digit month, barely, since March. Given the noisiness and volatility in a short time frame especially related to China, the more appropriate 6-month average has dropped to 5.8% even including September.

It’s the lowest since March 2017, very much consistent with the round trip for Reflation #3 being expressed by recent data across the Chinese economy. There just hasn’t been much of American demand for goods made in China and this weakness long predates the current stuff about trade tariffs and other restrictions.

US imports of capital goods continue to be the one sector where demand has been at least steady. At the other end of the spectrum, keeping a lid on everything is the automobile sector. Given how US auto sales have fallen slightly over the last three years since the prior downturn, it isn’t surprising that imports of foreign cars and trucks have likewise remained essentially flat.

That has left consumer goods to decide, so to speak, which way overall imports will go in any given month. Jumping late last year after Harvey and Irma, there was much less appetite for them in the middle of this year. In September 2018, imports here spiked pushing the overall total up as much as it did.

Leave A Comment