Durable goods continue to show that there is no difference between the economy of 2015 and the one being described by these numbers in 2016. To the “transitory” narrative, it is the death blow, which is why so many central banks and central bankers are busy exploring other options (while as quietly as they can writing down the future economy). To others, there is hope in that condition especially since for a time it looked like recession for this year. Where the glass is half full, at least 2016 hasn’t gotten a whole lot worse.

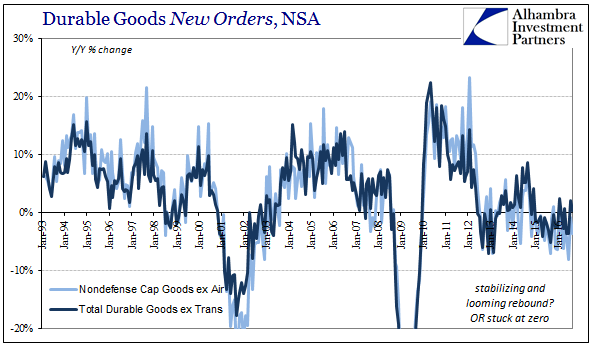

The statistics show that everything is stuck, at best. Durable goods shipments were down 0.5% year-over-year in September 2016 after being up almost 2% the month before; new orders were flat. Capital goods continue to see the worst of it, with new orders down almost 4% in the latest month while shipments fell by 5.2%. These circumstances are the continuation of two years of the wrong direction. To some, durable goods might show stabilizing, but in terms of capital goods businesses don’t appear to arrive at the same conclusion (and it’s not all energy-related).

The story of durable goods is the story of the economy itself. Why wouldn’t it be? It is a segment related to consumers in some of the most economically-sensitive ways possible. Big ticket items tend to sway with overall economic conditions, including consumer perceptions about the future. The less confident you are about what’s just over the horizon the less likely you are to buy expensive stuff.

It all started with the shock of the Great “Recession”, but if it was to be a recession and normal business cycle that meant the prospects of huge growth despite the enormity of the hole that the economy would have to be overcome. Monetary officials around the world knew the scope of the challenge, which is why they quickly turned to “extraordinary” policies and in heavy (it was thought at the time) doses.

Leave A Comment