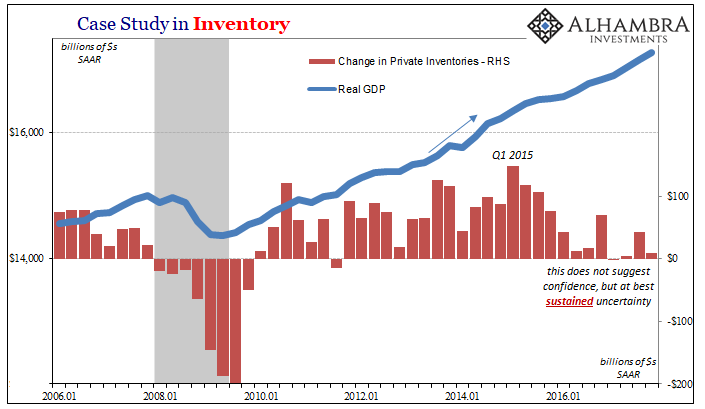

For GDP, one big piece that’s missing, or what’s kept it at a lower rate than in the comparable 2014 period, is inventory. Three and four years ago, American businesses couldn’t get enough. They piled into it at a record pace. The reason they did was almost surely Janet Yellen, or at the very least the mainstream economic projections that start always with the Fed’s upward biased models.

The BEA estimates that in the four quarters after the “rising dollar” began (Q3 2014 to Q2 2015), US firms took in around $400 billion of additional inventory. In dollar terms, it was by far the most in history; in percentages (of GDP) it was the largest inventory splurge since the late nineties. As an investment in the future, which is what inventory really is, it was on par with what the BLS was figuring in the jobs market.

Overall economic growth never really picked up all that much. The inventory was in anticipation of it doing so by 2015 at the latest. The unemployment rate suggested that even if the economy was still in low gear in 2014, there had to be a kick into high gear just around the corner.

Since that time, American businesses have been stuck in a sort of inventory limbo. A traditional recession always comes with an inventory liquidation; the desperate shedding of stockpiles of unsold goods as the approach of economic danger turns more immediate. The lack of liquidation, ironically enough, is what kept the 2015-16 downturn from becoming a full-blown cycle trough (a few quarters of negative GDP strung out over time).

Unlike in the past, there seems to be confusion manifesting as reluctance. If there was no inventory liquidation, there hasn’t been any restocking, either. That’s part of the difference lowering economic growth rates in 2017 versus 2014.

It’s not just inventory where this curious disinclination shows up. Other forms of business investment have been just as restrained. The most beneficial and basic of them is pure capex, the sort of productive investment any economy relies upon for baseline growth potential.

Leave A Comment