Photo Credit: John Carrel

Deere & Company (DE) Industrials – Machinery | Reports May 20, Before Market Opens

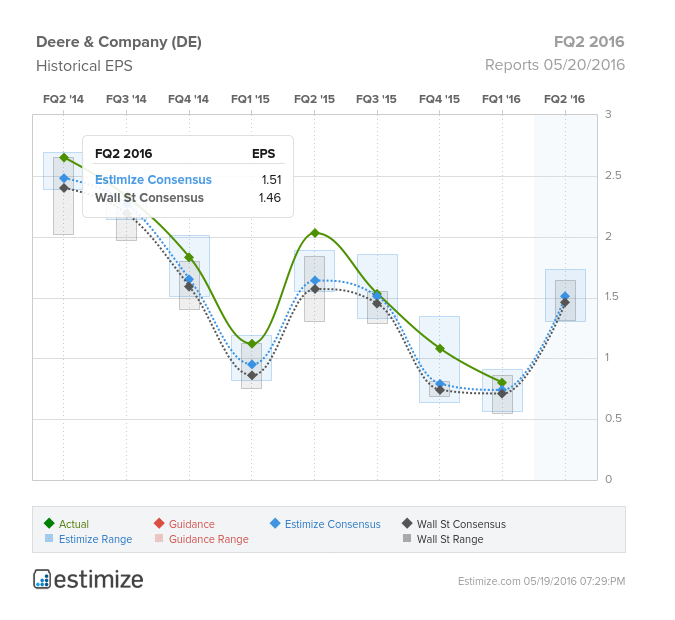

Deere & Company is scheduled to report fiscal second quarter earnings tomorrow before the market opens. The company is best known for manufacturing tractors and equipment used in agriculture, construction, and residential sectors. Weak results from competitors such as Caterpillar and AGCO earlier this season sets an unfavorable precedent for DE this Friday. In the past 2 years Deere & Co have seen double digit declines on both the top and bottom line. First quarter earnings featured a 74% decline in earnings with sales dropping 8%, as a result of weakness in global markets. In its analyst call, Deere & Co gave guidance that net sales this quarter would decline by an additional 8%. However, according to the Estimize consensus data, revenue is expected to fall 10% to $6.71 billion with earnings dropping 27% to $1.51. Given the volatility in this space, it’s not surprising the stock is down 7% from a year earlier. Deere should continue to see pressure on earnings and sales as the farm economy shows no signs of recovery.

The biggest problem lately has been a general weakness in demand for farm and construction equipment. The industrials and manufacturing sectors continue to take a beating as the overall economy remains sluggish. For Deere, this has caused earnings and sales to steadily decline. The company’s weak 2016 outlook suggest that these issues are expected to persist. Farming equipment sales are forecasted to decline 10% with sales in its construction and forestry unit expected to fall by 5%. Meanwhile persistent currency headwinds will take an additional toll on its results, with the company believing they will reduce equipment sales by 3% in FQ2 2016. Unfortunately, Deere is, for the most part, at the mercy of outside economic factors and until those pieces fall into place, results from the company will remain muted.

Leave A Comment