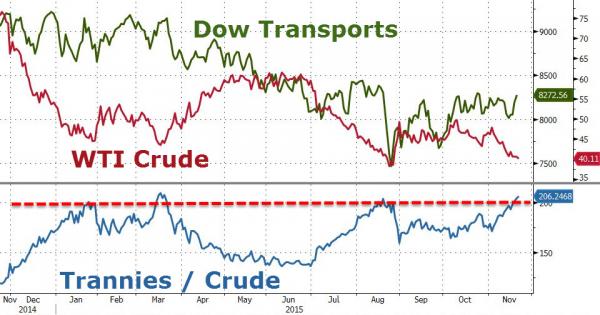

It appears European and US oil & gas stock investors (and Dow Transports lovers) believe they know better than commodity traders when it comes to some kind of future reality in which miracles of growth can happen. The disconnect between European oil & gas stocks, US energy stocks, and Trannies relative to crude oil has never been bigger…

What happened last time EU oil & gas stocks were this decoupled?

Here’s what one energy specialist said…

Pascal Menges, energy fund manager at Lombard Odier Asset Management in Geneva, says in e-mailed comments that recent outperformance attributed to 3Q earnings that “were not so bad,” helping attract attention to “perceived” div. yield sustainability of large cos.

Says 4Q results “likely to be very tough,” with oil price, refining margins down sequentially

Sees possibility that 4Q results in early 2016 “could surprise generalists,” referring to certain shareholders

Adds that generalists who have been buying European integrateds due to “sanctity of dividend might get worries”; with 4Q possibly illustrating “how uncovered those dividends are”

In other words, he is, as politely as possible saying – what are these idiots thinking?

But it’s not just the Europeans…

What happened last time US Energy stocks were this decoupled?

What happened last time Dow Transports were this decoupled?

Hint – Stocks Tanked!

Charts: Bloomberg

Bonus Chart: Energy credit is not buying it…

Leave A Comment