Market dislocations occur when financial markets, operating under stressful conditions, experience large widespread asset mispricing.

Welcome to this week’s edition of “World Out Of Whack” where every Wednesday we take time out of our day to laugh, poke fun at and present to you absurdity in global financial markets in all its glorious insanity.

While we enjoy a good laugh, the truth is that the first step to protecting ourselves from losses is to protect ourselves from ignorance. Think of the “World Out Of Whack” as your double thick armour plated side impact protection system in a financial world littered with drunk drivers.

Selfishly we also know that the biggest (and often the fastest) returns come from asymmetric market moves. But, in order to identify these moves we must first identify where they live. Occasionally we find opportunities where we can buy (or sell) assets for mere cents on the dollar – because, after all, we are capitalists.

In this week’s edition of the WOW we’re covering Mexico

Even before the “Anti-Christ” took the US presidency the market was gyrating like an overly intoxicated teen on spring break, trying to figure out what would happen to the country of drug dealers and rapists South of the border should the worst happen for them – the election of the devil instead of the basilisk.

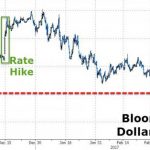

The peso was the favoured market punchbag, and if we look at the short-term trading during the US fiasco election it certainly looks like it took a knee to the groin and got at least one black eye falling by 13.4% – the most since the Tequila crisis of 1994-95 when Mexico was bailed out by the US and nearly went bankrupt, forcing them to devalue the peso.

Now, a month after the election I find my daily news feeds littered with pundits talking about Mexico. Who’s bullish, who’s bearish, and who just wants their face on TV and will say anything to to make it so?

Leave A Comment