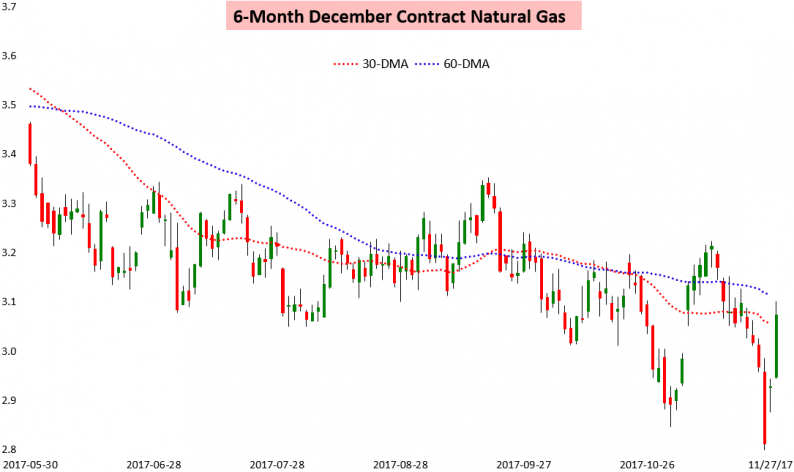

Today we take a look at an asset that rallied almost 5% day-over-day. No, not Bitcoin (which as we are writing this is up just 3.7%), but natural gas, which is finally realizing long-range cold weather risks. The December natural gas contract went off the board today after a massive jump.

The result was a significant rally all along the natural gas strip.

Additionally, for the sixth year in a row, that Z/F spread narrowed on Z (December) expiry day, though this year the narrowing was more significant than it has been as weather provided a further catalyst.

This rally has been fitting with a number of our more recent expectations. Our Weekly Natural Gas Report from last Monday (11/20) highlighted that prices should set a bottom last week and rally into December off increased cold, something we are now seeing.

In our Note of the Day from all the way back on October 17th we even highlighted why we saw uncommonly high odds for a cold December, helping traders position in advance of this coming cold snap.

Now, we see Week 3 CFSv2 American climate guidance showing significant cold risks for mid-December (courtesy of NOAA).

The 8-14 Day 12z American GFS ensemble 2-meter temperature anomaly forecast also shows significant cold risks across the East now.

Our latest weather analysis helped us to identify the bullish risks ahead of the rally today, and in our morning Text Alert we warned clients that the January contract was likely to hit $3.12, which we took out late this morning and settled just above.

Leave A Comment