Market Analysis

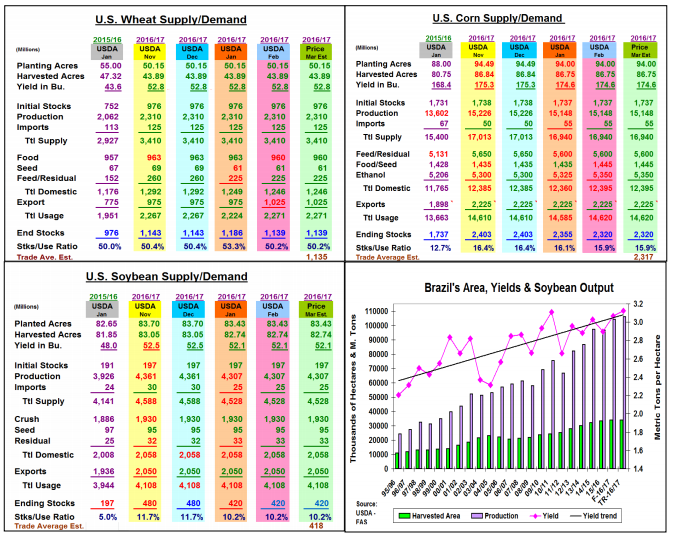

The USDA’s upcoming March World Production and US/World Supply/Demand revisions will be released on March 9. The World Board hasn’t traditionally made a lot of changes in their US and World Supply/Demand levels and ending stocks on this report. The USDA usually likes to see the quarterly stocks report released on March 31 before making changes in their domestic grain demand levels and normally a significant portion of S. America’s crops still remain in the fields. However, improved weather across the continent in the past month and reports of strong bean yields in Brazil’s northern harvest has the trade expecting a 2 mmt jump to 106 mmt in beans and 1.5 mmt increase in corn to 88 mmt.

US export sales remain on or ahead of their 5 year seasonal paces in wheat and corn at this time. However, sluggish shipping levels from lingering PNW rail issues still hanging over both markets likely keeps the USDA from making any overseas demand changes this month. In corn, US ethanol output remains on a record pace, but this hefty user of corn has slowed down seasonally. It will also experience some maintenance shutdown this spring ahead of its normal strong summer driving demand. Overall, no adjustments in either wheat’s or corn’s US old -crop ending stocks is expected this month.

In soybeans, a similar situation has occurred in exports. Sales are substantially ahead of its 5-year average pace. However, shipments have slipped slightly behind even as our inspection level have stayed above the 16 million weekly average needed to hit the current objective in the final 6 months of 2016/17 crop year. Current rainfall problems on Brazil’s northern highway to the Amazon may even extend stronger US shipments to compensate for this load out problem. Last week’s record overall US soybean crush for January at 170.6 million bu. may also prompted the USDA to leave soybean stocks unchanged.

What’s Ahead

Leave A Comment