Tesla (TSLA) released earnings after the close today. The stock went up a little and then went down a little so it doesn’t look like there is going to be a huge afterhours impact.

But it is what happens in the coming days and weeks with the stock that is going to be interesting because it is in a dead cat bounce price chart technical analysis formation.

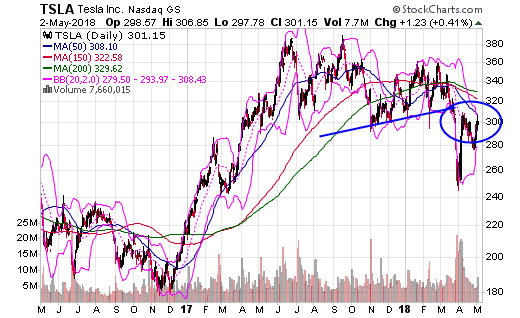

Take a look at the chart.

TSLA shares smashed through support in March and dumped. They have since bounced up to their 50-day moving average and near their 150 and 200-day moving averages, which are now acting as stiff resistance.

If the stock starts to drop and breaks $280 in the coming weeks it will complete a dead cat bounce formation and just dump.

There are worries that the company is doing nothing but increasing its debts as it posted its biggest quarterly losses ever in the last quarter. Musk is predicting though that it will make a profit before the year is over and so TSLA bulls are focused on his predictions. The funny thing is the company even announced an accounting gimick:

According to CNBC in a story on TSLA earnings:

“A change in Tesla’s accounting makes it impossible to directly compare Tesla’s year-over-year and quarterly numbers, including automotive revenue and gross margins. The company is now required to report lease transactions as sales, with all the revenue, income and costs for each lease recorded at once, rather than in monthly increments over the term of the lease.”

I am going to be watching what happens with TSLA now very closely because I shorted it back before it had it’s March dump and am still short. That means I’m betting against the stock because I think’s a bad one.

Now TSLA is not the only stock with a dead cat bounce formation that looks like it is in trouble.

Leave A Comment