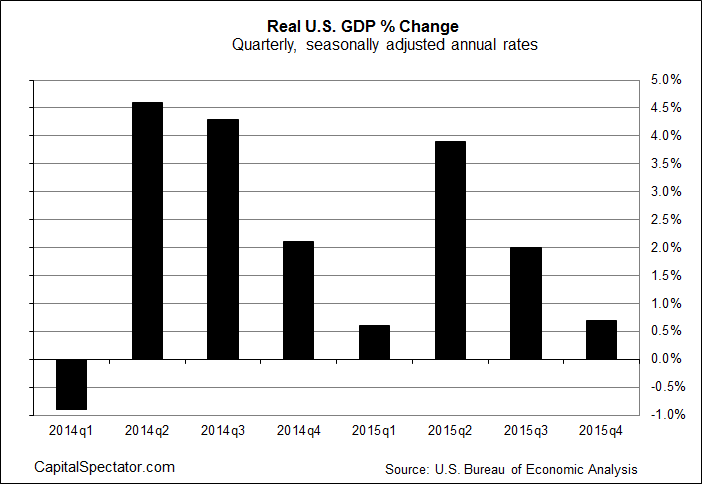

US economic output weakened in last year’s fourth quarter, according to this morning’s initial estimate of GDP. The pace decelerated to 0.7%, down from Q3’s 2.0% rise (seasonally adjusted annual rate). The softer trend was broad based, showing up in virtually every corner of the major components in the calculation of the GDP data. The question now: Is the Q4 stumble a sign of things to come or just a slow patch that, as in previous years, will quickly right itself via stronger growth?

The answer is unknown at this point, but clarity is coming in the next round of data, including next week’s January update on nonfarm payrolls. Meantime, it’s clear that the US economic trend suffered a sharp downgrade at 2015’s close.

On a relatively encouraging note, consumer spending—a key driver of GDP—continued to expand at a respectable if unspectacular rate: +2.2% in Q4. That’s down from Q3’s +3.2%, but it’s strong enough to keep the economy moving forward… assuming another downgrade isn’t brewing for this year’s Q1.

Note, too, that residential fixed investment and federal government spending delivered relatively strong performances in 2015’s final quarter relative to Q3. By contrast, the leading sources of weakness in Q4: a decline in business spending and tumbling exports. Combined with the slower growth in consumer spending, the resulting mix delivered a hefty deceleration in growth for the broad trend.

“The economy perhaps isn’t quite as strong as we thought it was — there’s clearly some very weak spots, but there’s a solid foundation to growth,” Nariman Behravesh, IHS’s chief economist, tells Bloomberg.

Perhaps, but there’s also more uncertainty about how the new year will fare. As for today’s GDP data, as usual it’s effectively old news. But at the moment there’s still minimal data for evaluating the macro trend in January, which will be critical for deciding if Q4’s weakness is a one-time event or something more ominous.

Leave A Comment