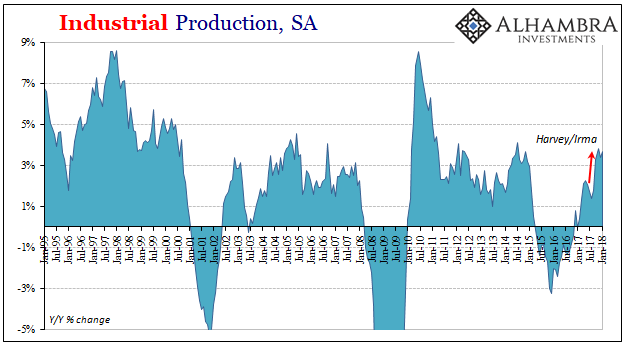

Industrial Production in the US was revised to a lower level for December 2017, and then was slightly lower still in the first estimates for January 2018. Year-over-year, IP was up 3.7%. However, more than two-thirds of the gain was registered in September, October, and November (and nearly all the rest in just the single month of April 2017).

It is very likely that what we are seeing for US industry is what has been slightly more apparent and further along in other places (like retail sales, for one). The big jump in production falls in the immediate aftermath of last summer’s vicious hurricane season. Rather than signal an organic acceleration in the goods economy, it was an anomaly, a one-time boost owing to cleanup and recovery from it.

If production does start to rollover, as we have expected, perhaps it will take some energy out of the inflation/boom hysteria currently in full force. I noted yesterday the coincidence in timing, this increasing economic confidence alongside what were predictably temporary gains. Intentional or not, the narrative risked from the start being unmasked for its obtuseness.

The Fed’s three diffusion indices bear out the further possible slowing ahead. While the 6-month comparison remains high (as we would expect), both the 3-month and especially the one-month have dropped considerably over the last two months. In December (these diffusion metrics are all one month further in arrears), the 1-month diffusion receded to 55.2 from a high of 61.5 back in October as the storm boost was in full swing.

The 3-month index had been 70.2 in November, but dropped to 59.9 in December indicating a greater likelihood of further weakness in the months ahead (like in the middle of 2017).

On the plus side remains oil production. For some reason, the IP estimates in this part of the mining segment were revised sharply higher for December against the overall revisions, which led to a lower January estimate than the month before. Whatever that was, statistical or real, IP in the oil patch continues to be actually robust.

Leave A Comment