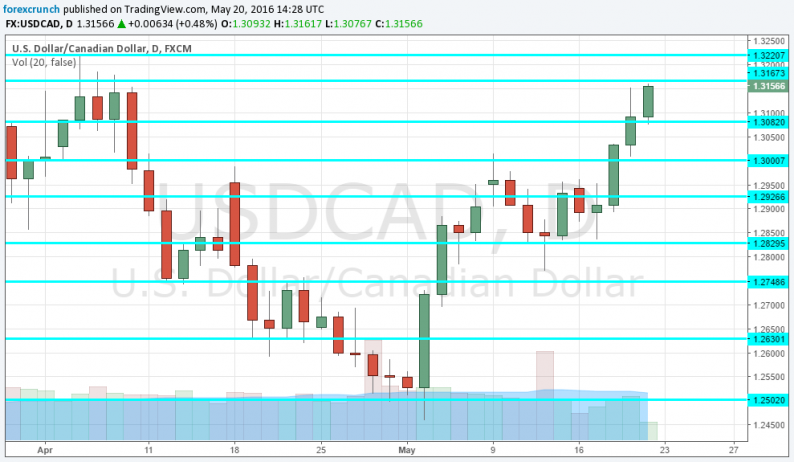

The Canadian dollar is having a terrible week and Friday is no different. USD/CAD is tackling resistance at 1.3170, the highest in a month, completing a 700 pip run from the lows.

Is this still a correction? It seems like a change of course. Here are 3 reasons for the fall:

Fresh fall in oil prices: The Alberta wildfires are still having an impact on oil production from Canada. While the reduced production pushes global oil prices higher, it doesn’t really help Canada that it can’t sell enough of the black gold. We have seen how a drop in price weighed on the loonie while a rise did little to cheer it. And now, WTI is sliding from the highs of above $49 to under $48. It’s not a lot, but every slides hurts the C$.

Mediocre Canadian data: The double feature of retail sales and inflation in Canada was far from favorable. Headline CPI rose only 0.3% instead of 0.4% expected m/m. Core CPI surprised with +0.2% instead of +0.1% but that was not comforting. In retail sales the miss on the headline was greater: -1% instead of 0.7% and the positive surprise in core sales was minimal: -0.3% instead of -0.4%. This is certainly far from enough.

A strong USD: Better than expected existing home sales gave the last positive push for the greenback in a week that saw a hawkish tilt from the Federal Reserve. The data is not so important and the surprise wasn’t big, but it also serves as a reminder: Canadian data missed and US data beat.

Here is how it looks on the daily Dollar/CAD chart.

Leave A Comment