Fundamental Forecast for Japanese Yen: Bullish

USD/JPY fails to test the July-high (114.50) as the Federal Open Market Committee (FOMC) keeps the benchmark interest rate on hold in November, with the pair at risk for a near-term correction amid the mixed reaction to the key developments coming out of the U.S. economy.

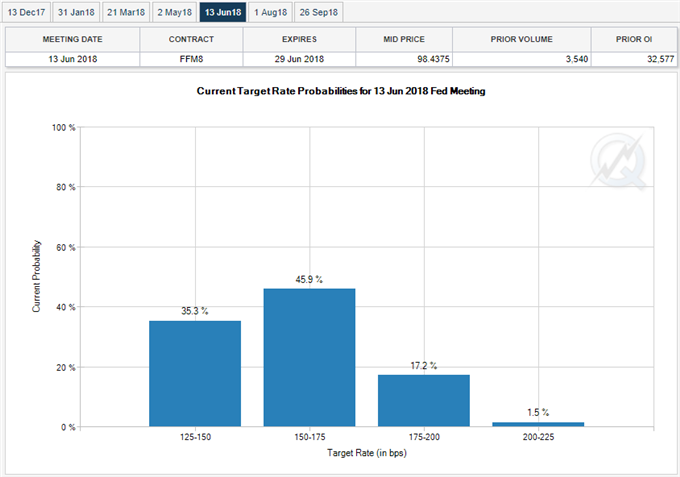

Even though Fed Fund Futures continue to price a greater than 90% probability for a December rate-hike, the 261K expansion in U.S. Non-Farm Payroll (NFP) paired with the unexpected pickup in the ISM Non-Manufacturing survey have done little to influence interest-rate expectations as market participants see the FOMC staying on hold until June 2018. With U.S. President Donald Trump nominating Fed Governor Jerome Powell to replace Chair Janet Yellen, it seems as though the central bank will stay on course to deliver three-hikes per year, but the FOMC may ultimately reach the end of its normalization cycle ahead of scheduled as a growing number of central bank officials trim the longer-run forecast for the benchmark interest rate.

As a result, the FOMC may implement a dovish rate-hike ahead of 2018 in response to the larger-than-expected slowdown in Average Hourly Earnings, and the ongoing weakness in household earnings may continue to dampen the appeal of the greenback as ‘market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.’

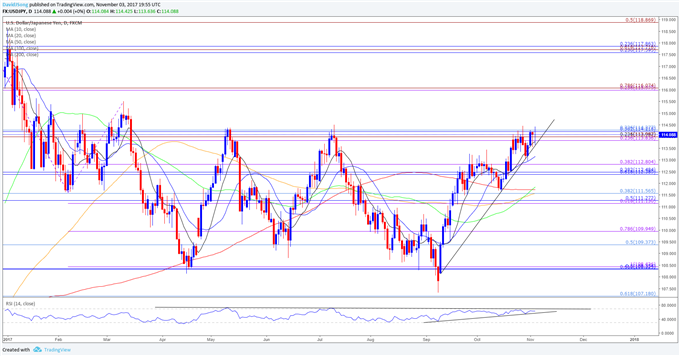

USD/JPY Daily Chart

The advance from the September-low (107.32) appears to be getting exhausted amid the string of failed attempt to clear the July-high (114.50), with the broader outlook for USD/JPY confined by the range from earlier this year. Keeping a close eye on the Relative Strength Index (RSI) as it highlights a similar dynamic and appears to be flattening out ahead of overbought territory. With that said, a break of trendline support accompanied by a close below the Fibonacci overlap around 112.30 (61.8% retracement) to 112.80 (38.2% expansion) will bring the downside targets back on the radar, with the next region of interest coming in around 111.10 (61.8% expansion) to 111.30 (50% retracement).

Leave A Comment