It may have been against the odds, but not only did the market rock and roll last week, it forged its way into new high territory on Wednesday, and as of Friday’s close was still moving deeper into record-breaking highs. Volume, though not exactly brisk, wasn’t bad. The move silenced a lot of doubters.

And yet, it’s in cases like this where traders should be the most cautious. This is a technical breakout, and after three days of bullish persistence, this is where the market could throw a curve ball and up-end the rally while nobody’s ready for it.

Or, who knows? This may all be the beginning of a trade-worthy meltup, even if it’s not justified from a fundamental perspective.

We’ll hash it all it below, as always. First though, let’s run down last week’s and this week’s major economic announcements. They’re going to play a big role in extending or breaking the rally effort that’s getting a little long in the tooth.

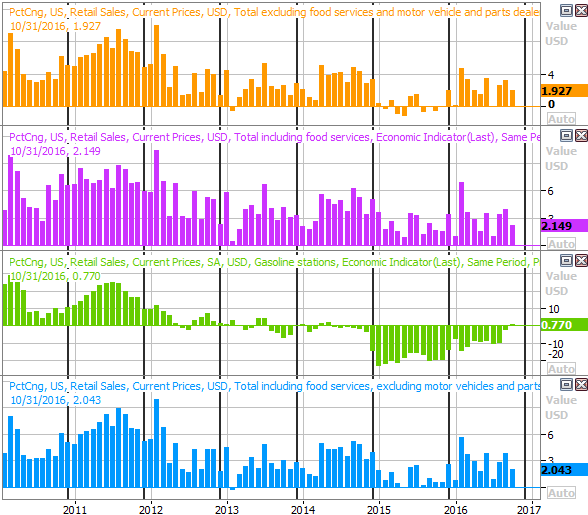

Economic Data

Last week wasn’t a terribly busy one for economic news. The only two items of interest were last month’s ISM Services reading (rounding out the prior week’s look at the ISM manufacturing index), and the first of three December readings for the Michigan Sentiment Index.

Not only are both versions of the ISM indices edging higher, both are now well above the key 50 mark. Yet, we’d like to see a little more upward progress.

ISM Indices Charts

Source: Thomson Reuters

Not surprisingly, consumer sentiment continues to perk up, fueling and being fueled by the rising market.This too bodes well for the market, decidedly ending a rut for both the Michigan Sentiment Index as well as the Conference Board’s Consumer Confidence Index two weeks ago. This won’t stave off short-term pullbacks, but it does provide a tailwind for the long-term market.

Consumer Sentiment Charts

Source: Thomson Reuters

Everything else is on the grid.

Economic Calendar

Leave A Comment