The recent Fed non-decision on interest rates increased worries about global economic weakness. Trading in commodity markets underscores a widespread perception of a potential recession. The week ahead is packed with fresh economic data, including the most important reports. The punditry will be asking:

Will the U.S. economy succumb to global weakness?

Young Writers

Consider entering the competition for the Bracken Brower prize. You need to be under age 35 to compete for this very meaningful award. Entries close on 9/30 at 5 PM British Summer Time, so do not delay further.

Prior Theme Recap

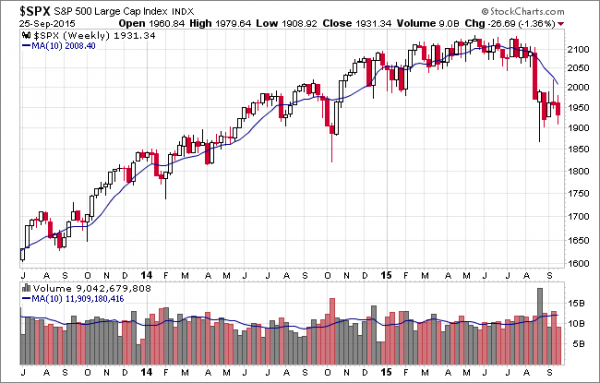

In my last WTWA I predicted that it would be a week for Fed critiques and reviews, including commentary and speeches from the actual participants. I expected the Fed to “clarify” the message that many took from the post-decision announcement. That was a fairly accurate guess for the major theme, but there was plenty of competition from the Pope, the President of China, and the Speaker of the House. The S&P 500 (SPY) declined 1.36% on the week, with the Nasdaq (QQQ) and small stocks doing worse. To put this in perspective, here is a different chart from Doug Short’s excellent weekly recap – a look back over nearly two years. As always, the full article includes several other helpful charts. (With the ever-increasing effects from foreign markets, you should also add Doug’s World Markets Weekend Update to your reading list).

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

This Week’s Theme

The Fed is concerned about the global economy. Or maybe not. Markets trade daily on a risk on, risk off basis, led by commodity and energy prices. Many believe that the U.S. economy is on life support. With plenty of economic data on tap we have new evidence for the ongoing debate. I expect the pundits to be asking:

Will the US economy succumb to global weakness?

As always, the viewpoints are varied.

The Viewpoints

The wide range of economic forecasts includes the following:

- The U.S. is already in a recession. QE4 is needed. The ECRI has a creative recession definition supporting this. (Via Doug Short).

- Market indicators suggest that a recession is imminent.

- The economy is showing modest growth, but we have an earnings recession. (FactSet’s Q3 estimates call for a decline of 4.5%, which would be the first two-quarter decline since 2009). Brian Gilmartin notes that full-year 2015 will probably be positive.

- Sluggish growth continues, overcoming the global drag, but only weakly. The Atlanta Fed’s GDP Now project presents this picture:

- Growth is improving, but gradually. (This is the mainstream economic viewpoint – major economists and the Fed. For specific China attention see also Dallas Fed via GEI).

- Q2 signaled the start of a real economic rebound.

Josh Brown has a good discussion of this. While the economic debate is important, the major focus remains with the risk-on, risk off psychology.

As always, I have my own ideas in today’s conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

The Good

There was some good economic news.

New highs in bearishness – a contrary indicator. Mark Hulbert has the story.

Leave A Comment