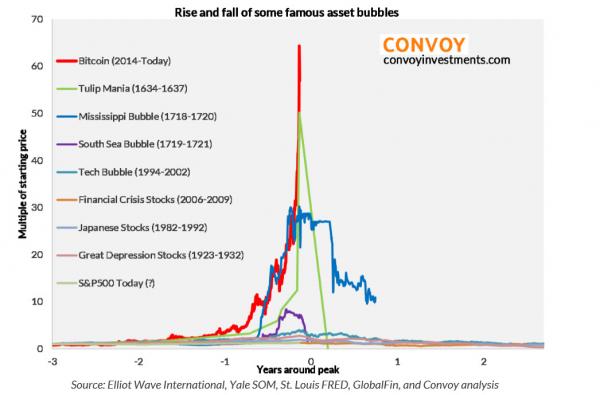

As we showed yesterday, the price of bitcoin has finally surpassed “Tulips” in the global bubble race.

Overnight the former Bridgewater analysts Howard Wang and Robert Wu, who make up Convoy Investments, released their thoughts on what happens next… and most importantly, what causes asset bubbles…

When we see a dramatic rise in asset prices, there is often an internal struggle between the two types of investors within us.

The first is the value investor, “is this investment getting too expensive?”

The second is the momentum investor, “am I missing out on a trend?”

I believe the balance of these two approaches, both within ourselves and across a market, ultimately determines the propensity for bubble-like behavior. When there is a new or rapidly evolving market, our conviction in the value investor can weaken and the momentum investor can take over. Other markets that structurally lack a basis for valuation are even more susceptible to momentum swings because the main indicator of future value is the market’s perception of recent value. In this commentary, I quantify the balance of value vs. momentum in a market to explore how that tug of war can result in incredible asset bubbles.

The balance of value vs. momentum determines a market’s serial correlation

I believe the outcome of the tug of war between value and momentum in any market can be largely captured by a statistical measure called serial correlation – how likely is the recent past to determine the near future? A value of -1 means future returns are the exact opposite of recent past returns, a value of 0 means they are independent of each other, and a value of 1 means recent past returns are perfectly predictive future returns. After a dramatic price change, value investing would generally expect a reversion to the mean, suggesting a negative serial correlation. Momentum investing would expect that trend to continue, implying a positive serial correlation. A value-focused investor base tends to lower serial correlation while a momentum focused investor base tends to increase serial correlation. The balance of the two determines the aggregate level of serial correlation in a market.

In reality, most markets see a relatively even balance between value and momentum and their returns are serially uncorrelated most of the time. Of course, every market will also experience periods when investors lose conviction in value and momentum dominates. A rise in serial correlation can occur when investors don’t have an established framework of value in new and opaque markets such as the complex structured products in the years leading up to the 2008 Financial Crisis. Investors didn’t trust in their own independent valuation of their portfolio and relied on recent price climbs as an indicator of future returns. Serial correlation can also rise in rapidly evolving markets such as technology in the late 90s. During those periods, the industry is dramatically reshaped and investors lose faith in their traditional value framework and again rely on recent price changes as the main metric for future price changes.

While the logic around serial correlation is basically common sense, below I quantify why serial correlation is so statistically important and just how powerful it can be in creating asset bubbles.

Leave A Comment