Bank of America (BAC) is my favorite bank stock right now, and its future looks a lot brighter. The share price could double from here.

Bank of America has underperformed for a number of years in an already-shaky banking sector, with added uncertainty regarding interest rates, economic growth, lending, income generation, and regulation. But the worst is now likely behind BofA (BAC), and investors could begin to warm up to and even chase the stock due to very attractive and deeply-discounted valuations, strong cash flows, a growing dividend, increasing earnings, peer outperformance, and an improving overall environment.

Note: Click on images/charts to enlarge

After collapsing during the financial crisis of the Great Recession (2007-2009), Bank of America (BAC) has been stagnant during the economic recovery which followed. Though the stock bottomed in early 2009 and again in late 2011, it has done almost nothing for three years since 2013.

Bank of America (BAC) has underperformed the broad Financials sector (XLF).

BAC is significantly lagging Since the 2007 peak:

BAC is significantly lagging since the the beginning of 2010, with a negative return while Financials (XLF) as a whole are up big:

Now is the time to BUY Bank of America (BAC), and here’s why:

VALUATIONS

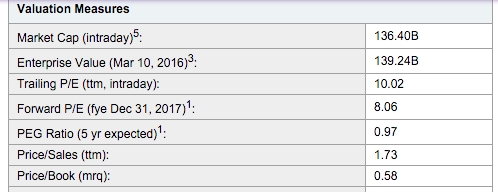

Bank of America is trading at very attractive valuations, selling at a deep discount likely due to overblown fears.

The stock is currently trading at a Price-to-Earnings ratio (P/E) of 10 and a forward P/E of 8. Moreover, the P/E ratio has dropped considerably to a low not seen since 2012:

Furthermore, the stock is selling at nearly HALF its Book Value (P/B) and even below its Tangible Book Value (P/TB):

Most Bank stocks have been selling at discounts to Book Value or close because of all of the fear surrounding the sector. But with much of the Financial Crisis and potential hurdles behind us, buying BAC at around half of BV is a steal.

FINANCIAL STRENGTH

Leave A Comment