Bank Of Japan Is In Trouble

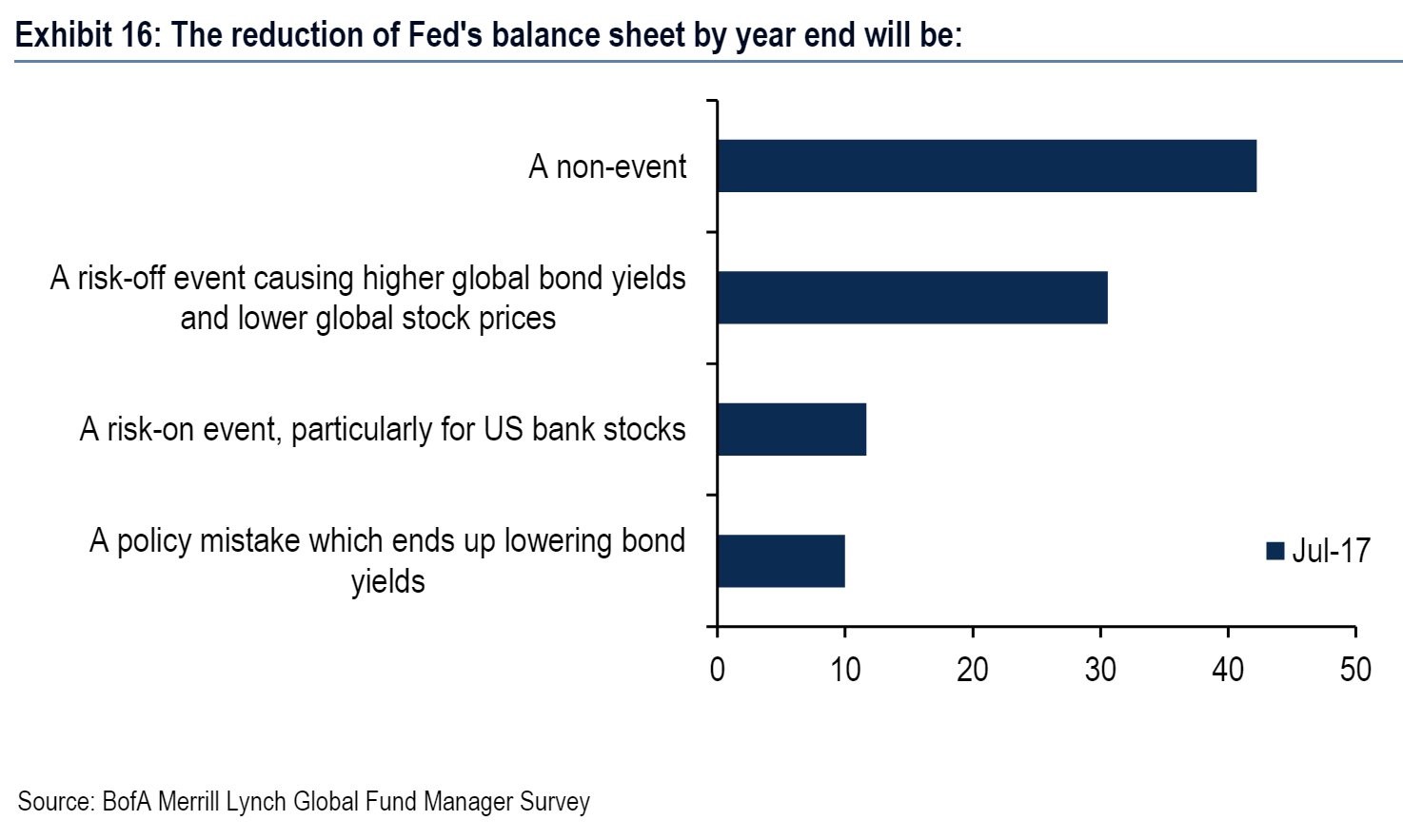

The unwind potential of the central banks’ assets that is about to hit the market is remarkable in its scope; the fact that it’s all happening at once only adds to the drama. There could be currency implications if the ECB decided to increase its bond buying while the Fed unwound which is why it is globally coordinated. It’s like the Fed is trying to lead the central banks out of the wilderness. Clearly my worry is not being picked up by market participants as the stock market has had little reaction to the guidance. The survey below gives you a picture of what you can already figure by the action as about 55% think the Fed’s unwind will be a non-event or possibly a boon to stocks, particularly banks. I wish the question included 2018 because that’s when the results will play out as the Fed takes baby steps and the ECB begins to taper then. It’s also an awkward thing to say that the Fed unwinding is a policy mistake because this can be the correct action and simultaneously cause weakness in the economy. Every Fed hike weakens the credit market, but not all hikes are mistakes. I think this is the right thing to do, but it has consequences.

A great explanation of what is expected to happen is shown in the two charts below. First, we have the bank of Japan’s holdings of government debt and then we have the Credit Suisse forecast for the JCB to stop purchases in 2020. At face value, that forecast seems improbable. If you look at Fed forecasts of its own policy on interest rates, reality is always much lower than what the Fed sets out. In this case, I expect the JCB to either slow its buying less than expected or not at all. At the same time, the JCB is also running out of assets to buy so it might not be a voluntary decision. As you can see, there was a slight unwind in the mid-2000s, but the JCB has never held this much bonds and equities.

Leave A Comment