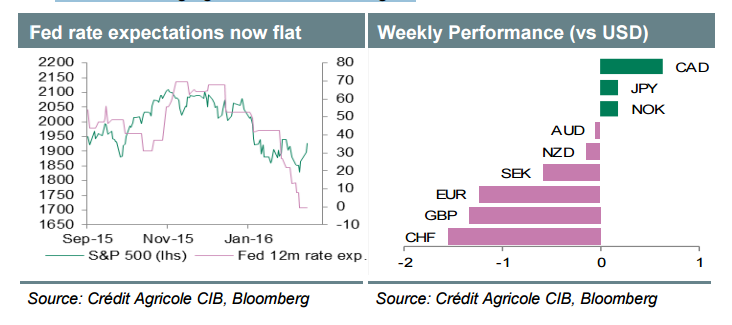

The weekend did not provide a relief from headlines, with the EU/UK deal taking center-stage. In the upcoming week we can certainly expect volatility, as the team at Credit Agricole explains: Here is their view, courtesy of eFXnews: Risk sentiment

February 21, 2016