The weekend did not provide a relief from headlines, with the EU/UK deal taking center-stage. In the upcoming week we can certainly expect volatility, as the team at Credit Agricole explains:

Here is their view, courtesy of eFXnews:

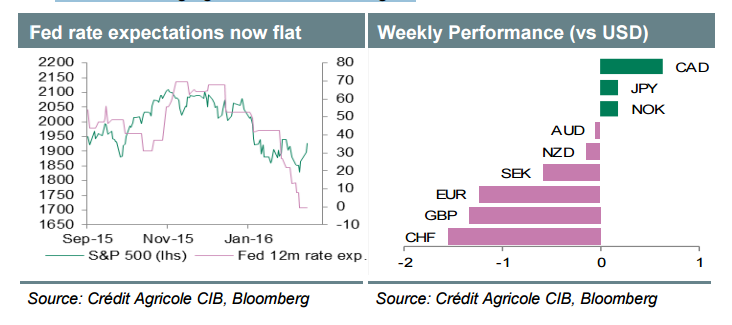

Risk sentiment improved this week, irrespective of weaker Chinese trade data keeping fears over the need of a further CNY depreciation intact. Considering this week’s FOMC meeting minute’s and Fed members’ more cautious rhetoric, a large part of this week’s improvement can be attributed to decreased Fed rate expectations. This explains too why the greenback failed to appreciate this week.

Looking ahead, we believe that global growth uncertainty is likely to keep cross market volatilities high. This, however, does not exclude further improving sentiment, especially considering that the focus will increasingly shift to the G20 meeting at the end of February.

Although it cannot be excluded that the USD faces more downside risk in the short term. We believe dips should be bought. This is especially true as further falling Fed rate expectations would imply policy easing. This appears unlikely unless incoming data weakens considerably.

Commodity currencies performed well by the end of the week. When it comes to the NOK and CAD it will remain about oil price developments to drive these currencies, especially as respective central bank rate expectations have been stabilising. Should the greenback become more supported anew, this is likely to prevent oil prices from correcting considerably higher.

What we’re watching

USD – Next week’s PCE data will be key. Only a considerably weaker than expected outcome may lower rate expectations further.

GBP – Growth data should become a more important currency driver anew. Hence next week’s GDP data will be closely watched. We see limited GBP downside risk from the current levels.

JPY – It remains to be seen if weaker inflation data will drive the JPY lower. This is due to increased uncertainty about the BoJ’s policy stance being efficient in bringing inflation back to target.

Leave A Comment