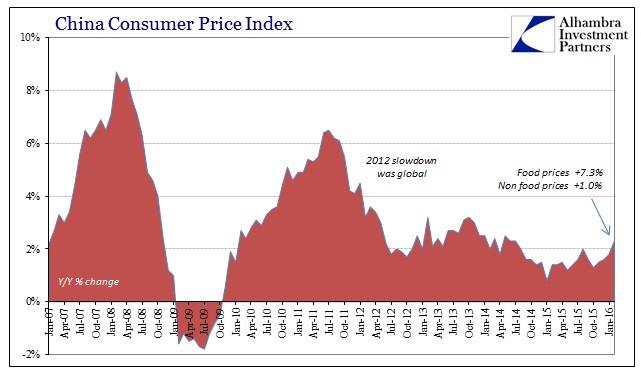

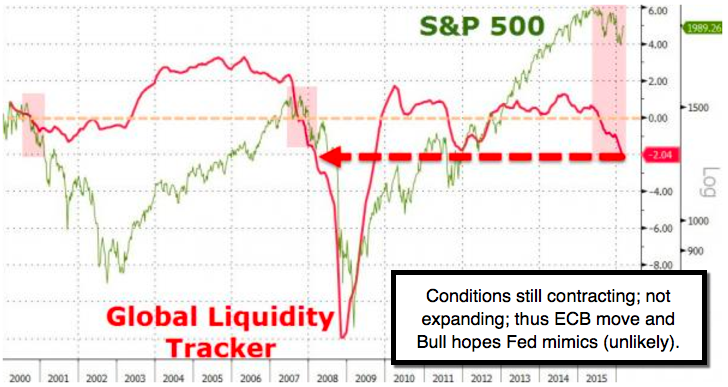

Europe is not the only location seeking out more “inflation”, as almost any central bank around the world except Banco do Brasil would do anything to find it. The ECB provided more emphasis in their panicked escalation today. In China, by contrast,

March 10, 2016