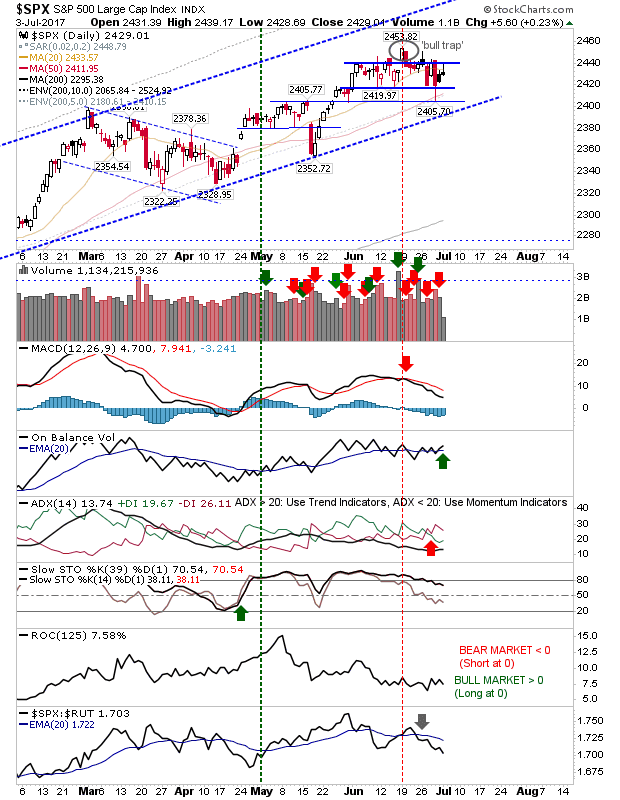

Whenever there is a national holiday and especially July 4th, volumes are light which can result in larger moves and higher volatility. Given that North Korea tested another missile earlier today the effect on markets was more extreme than would

July 4, 2017