Econintersect’s Economic Index continues to forecast strengthening economic fundamentals – with the index showing normal growth for the third month in a row. Six-month employment growth forecast indicates modest improvement in the rate of growth.

Analyst Summary of this Economic Forecast

This month the internals of our index continue to be aligned in positive territory – all with positive contributions to Main Street. What I am saying is the fundamentals are strengthening but the noticeable effects will be slight.

Retail sales including autos are very soft. The consumer appears not to want to carry additional debt – but their situation is strengthening but is not resulting in trips to the spending trough.

Our 6-month employment forecast is improvement in the rate of employment growth.

This index is not designed to guess GDP – or the four horsemen used by the NBER to identify recessions (industrial production, business sales, employment and personal income). It is designed to look at the economy at the Main Street level.

The graph below plots GDP (which has a bias to the average – not median – sectors) against the Econintersect Economic Index.

This post will summarize the:

The Econintersect Jobs Index is based on economic elements which create jobs, and (explanation here) measures the historical dynamics which lead to the creation of jobs. It measures general factors, but it is not precise (quantitatively) as many specific factors influence the exact timing of hiring. This index should be thought of as a measurement of jobs creation pressures.

For the last year, jobs growth year-over-year (green line in below graph) is averaging between the levels forecast by the Econintersect Jobs Index (blue line in below graph), and a fudged forecast (red line in below graph) based on deviation between forecast & current actual using a 3 month rolling average.

The fudge factor (based on deviation between the BLS actual growth and the Econintersect Employment Index over the last 3 months) would project jobs growth at 185,000. This fudge factor is fluid (subject to change) as the BLS has significant backward revision to their jobs numbers.

This post will summarize the:

Special Indicators:

The consumer is still consuming. The ratio of spending to income has been elevated since Jan 2013. There have been only four periods in history where the ratio of spending to income has exceeded 0.92 (April 1987, the months surrounding the 2001 recession, from September 2004 to the beginning of the 2007 Great Recession, and for some periods since late 2013 thru 2014). A high ratio of spending to income acts as a constraint to any major expansion in consumer spending. The current trend since the beginning of 2016 is the consumer spending a larger portion of their income.

Seasonally Adjusted Spending’s Ratio to Income (an increasing ratio means Consumer is spending more of Income)

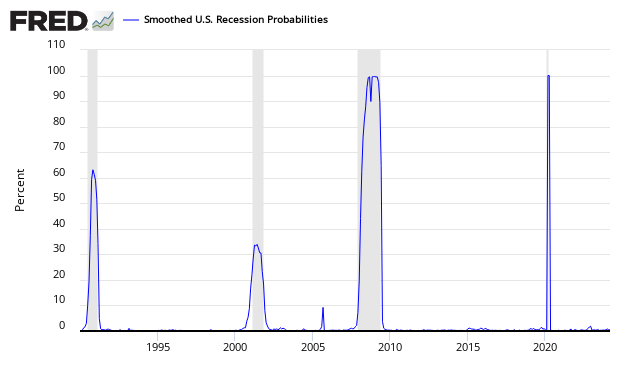

The St. Louis Fed produces a Smoothed U.S. Recession Probabilities Chart which is currently giving no indication of an oncoming recession.

Smoothed recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. This model was originally developed in Chauvet, M., “An Economic Characterization of Business Cycle Dynamics with Factor Structure and Regime Switching,” International Economic Review, 1998, 39, 969-996. (http://faculty.ucr.edu/~chauvet/ier.pdf)

Econintersect reviews the relationship between the year-over-year growth rate of non-farm private employment and the year-over-year real growth rate of retail sales. This index is currently slightly negative. When retail sales grow faster than the rate of employment gains (above zero on the below graph) – a recession is not imminent. However, this index has many false alarms.

Growth Relationship Between Retail Sales and Non-Farm Private Employment – Above zero suggests economic expansion

Leave A Comment