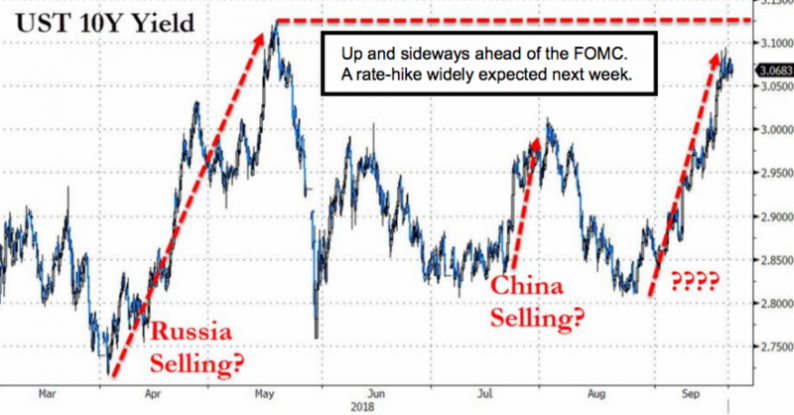

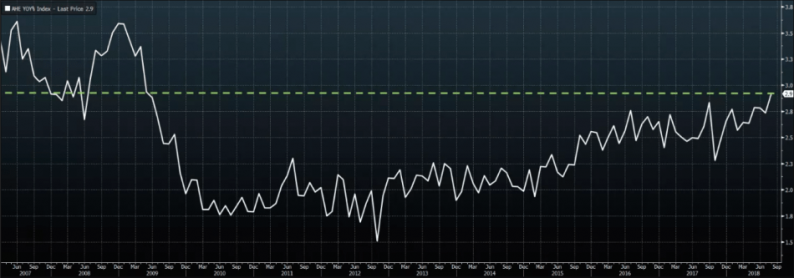

A slightly more sober performance by markets as ‘Quadruple Expiration‘ has wrapped up, is being telegraphed, and likely looms immediately ahead. Of course markets will ponder the Fed rate increase (essentially discounted in terms of actual Treasury moves) and talk about tariff-related prospects.

September 23, 2018