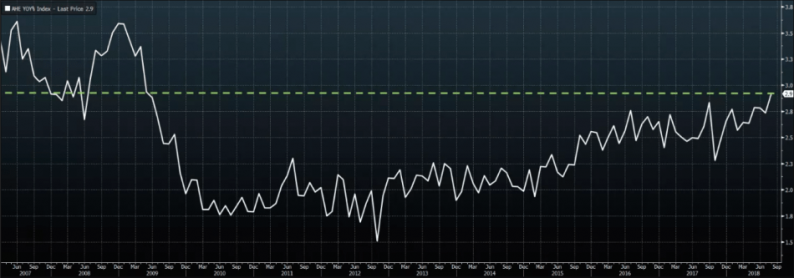

“Yields: On the march!”, Jeff Gundlach tweet-shrieked, on Tuesday, before chiding the media for not paying enough attention to market action that essentially invalidated his “monumental” short squeeze pseudo-prediction.

“10’s above 3% again, this time without financial media concern”, he continued, adding that everyone should “watch 3.25% on 30’s [because] two closes above = game changer.”

If I had to sum up last week in rates and FX, I guess I’d just say that Jeff was surprised that nobody seemingly cared about the Treasury selloff and everybody else was surprised the dollar didn’t respond to yield rise.

Implicit in that admittedly oversimplified take is the notion that folks did not in fact ignore the latest bond selloff. Rather, everyone was just more focused on the dollar taking a breather. That’s because greenback weakness is more important from a near-term perspective to the extent it helps relieve some of the pressure on downtrodden emerging market assets and just generally loosens up global financial conditions. A weaker dollar also has the potential to give new life the global reflation story and you saw some of that last week in the commodities rally. Of course as Goldman notes, the causation works both ways – decreased appetite for Treasurys amid a risk rally is dollar negative.

There are some shades of late January/early February here when it comes to bonds. You’ve got a selloff and the average hourly earnings print that accompanies the next jobs report will be scrutinized heavily, coming as it does on the heels of the August number, which showed wages rising at the fastest annual pace since 2009.

(Bloomberg)

A series of positive surprises on wage growth or maybe a couple of super-hot CPI prints could conceivably be trouble, to the extent that forces the market to reevaluate deeply- held convictions about the Fed.

“Our broad view is risk markets, including the markets for EM assets, can live with the Fed balance sheet reduction and rate increases that lie ahead for the remainder of the year on the condition that the pickup in both US wage growth and term risk premia in the UST market remain slow, and the market’s views on the neutral Funds rate is not shaken in a major way”, Credit Suisse wrote last week, before cautioning that “if that condition is violated, real yields across the US curve may rise sufficiently to cause a major problem for all risk assets, not least in EM space.”

Leave A Comment