Abbott Laboratories (ABT) spun off its major pharmaceutical business AbbVie (ABBV) in December 2012.

The rationale for the spin-off was that it would allow Abbott to focus on its balanced health care business, which is split among medical devices, consumer products, and international pharmaceuticals.

At the same time, Abbott management believed AbbVie, as a growth company, would earn a higher valuation multiple if it were trading on its own.

It’s clear that management was right. Since the IPO, AbbVie stock has risen 83%.

By comparison, Abbott stock is up a more modest 25% in the same time.

Both companies are strong dividend stocks. In fact, Abbott is a Dividend Aristocrat. These are companies in the S&P 500 that have increased their dividends for at least 25 consecutive years.

For investors who don’t own either stock, or are considering adding to existing holdings after the spin-off, this article will discuss why AbbVie is the better stock to buy today.

Post-Split Performance

Abbott and AbbVie came from the same origins, but they are much different companies. AbbVie generates 100% of its revenue from pharmaceuticals.

This strategy has worked very well for AbbVie to this point. The company’s sales and adjusted earnings-per-share both increased 12% in 2016.

While AbbVie is a pharmaceutical pure-play, Abbott’s business model is broken up into four operating segments:

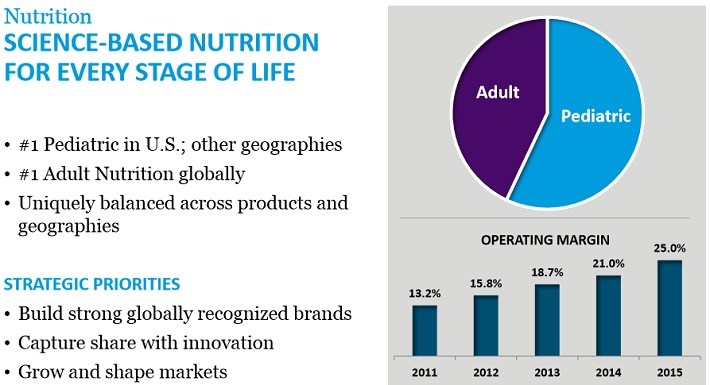

Abbott’s businesses enjoy dominant industry positions. For example, Abbott enjoys the No. 1 position in adult nutrition globally, and in U.S. pediatric nutrition sales, thanks to its Ensure and Pedialyte brands.

These top brands provide the company pricing power, which fuels high profit margins in its core nutrition segment.

Source: JP Morgan Healthcare Conference, page 7

Leave A Comment