Square, Incorporated (NYSE: SQ) expects to raise $324 million in its upcoming IPO. Based in San Francisco, California, Square develops and provides point-of-sale software worldwide.

Square will offer 27 million shares at an expected price of $11 to $13. If the underwriters price the IPO at the midpoint of that range, Square will have a market capitalization of $3.9 billion.

Square filed for the IPO on October 14, 2015.

Lead Underwriters: Goldman Sachs, J.P. Morgan Securities, and Morgan Stanley

Underwriters: Barclays Capital, Deutsche Bank Securities, Jeffries LLC, LOYAL3 Securities, RBC Capital Markets, SMBC Nikko Securities, and Stifel Nicolaus

Business Summary: Developer and Maker of Point-of-sale Software for Use with Smartphones and Tablets

(click to enlarge)

(Source)

Square, Inc. develops and offers point-of-sale software utilized worldwide primarily through smartphones and tablets. The company also offers Square Register, which is a point-of-sale system that provides digital receipts, analytics, feedback, sales reports and manages inventory. Square promotes its products as one cohesive service to run an entire business by turning mobile devices into registers, providing analytics through any computer, as well as offering small business financing and marketing tools.

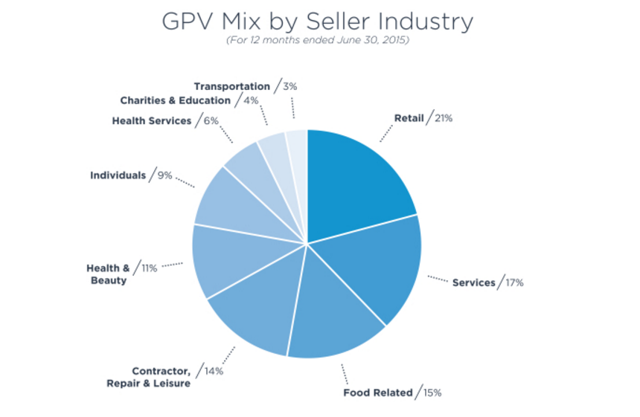

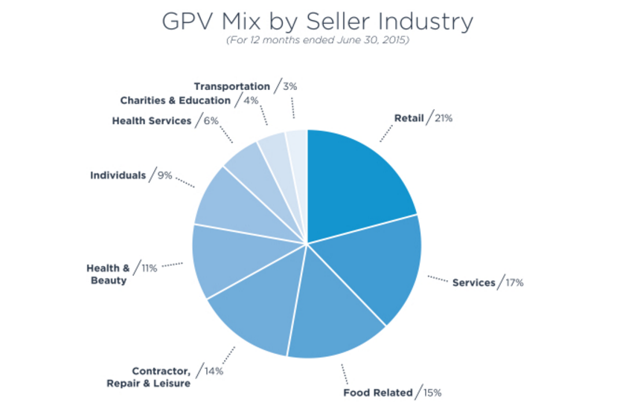

Square derives the majority of its revenue from sales in the United States, although it has a growing customer base in Canada and Japan. Its sellers range from individual venders to multinational organizations, and its products can easily scale as a business grows.

In the 12 months ended September 30, 2015, Square processed $32.4 billion in gross payment volume (GPV) through 638 million card payments made from approximately 180 million payment cards. Square generates revenue as a percentage of the GPV, and the company noted that in the same period, over two million sellers accepted five or more payments through Square, which represented approximately 97 percent of its GPV.

Leave A Comment