For much of 2015, I was criticized for being too bearish. The U.S economy was expected to finally grow at 3.0% (or better) and interest rates (particularly long-term rates) were expected to soar. I had a very contrary view, particularly versus views being espoused in the wealth management industry. There were few signs of inflation, necessary for rising long-term rates and anti-growth headwinds were blowing harder from overseas. The retail side of the business swallowed the stronger corporate balance sheet story hook, line and sinker in spite of balance sheet evidence to the contrary. The first rumblings of equity market trouble materialized last summer. Most pundits blame China for the equity market rout, but the corporate credit markets had been signaling trouble for about a year.

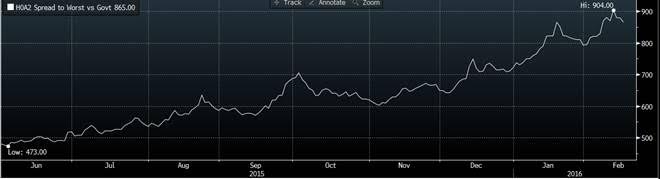

Credit spreads of B-rated U.S. corp. bonds vs. UST benchmarks since 6/14 (Source: Bloomberg):

The bond market has been signaling trouble among corporate credits, particularly among junk-rated corporate credits. However, trouble in emerging markets and consistently falling long-dated UST yields indicated that growth would probably not be strong enough to overcome structural deflationary forces around the world.

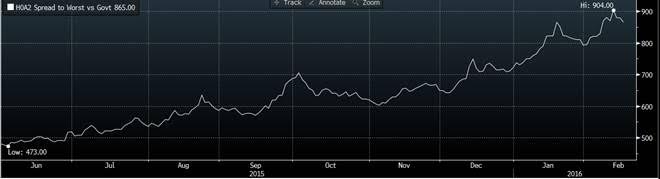

UST 10-year Note Yield since Jan. 2014 (Source: Bloomberg):

Bond market conditions and economic data were clearly indicating that the pace of growth slowing and inflation pressures were lessening. My outlook and strategy simply reflected what the data were stating. Bond market behavior during this time lent credence to my outlook.

By late December, following a failed attempt by risk asset markets to fully recover from the summer rout (which I pointed out was faltering in October of last year), my-less-than-bullish base case scenario was playing out.

As the calendar rolled around to January, market and economic conditions deteriorated. The cry from pundits, market participants and even some Bond Squad readers was: Recession is near!

Leave A Comment