Daily action has essentially cautioned fading rallies and not chasing rallies; in what has been an alternating ‘demolition derby’ of trend-follow tactics used by so many traders and commodity-oriented speculators as they try to ‘make’ the market conform to some rigid system or guideline.

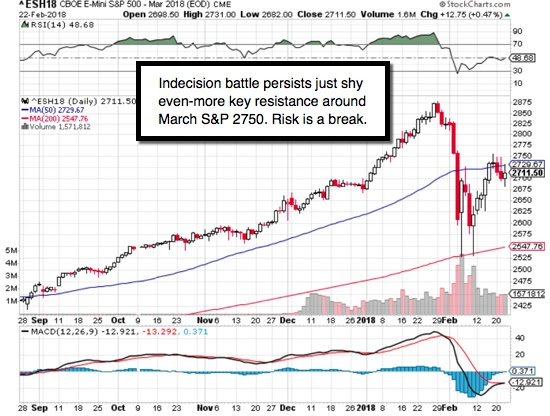

As I’ve warned this is not that kind of market. The daily ‘gear-shifting’ is not occurring at either an important top (behind) or even trading low (it’s also behind); but as a struggle around a key resistance area. Because it does happen to correlate with a ‘standard deviation’ retracement; as well as a declining tops pattern I’ve outlined in videos; you will have very frustrated bulls and bears trying to define it technically; react to the shifts higher or lower technically; while often loosing context of the big picture.

That big picture is that this is simply a rebound after a ‘flash crash’ and it has little chance of ‘meaningful’ extension; even if it were to surmount at least the near-term resistance zones. That’s the point about foolishness related to those investing rather than trading (especially well off the lows of our forecast earlier-February purge).

And all of that omits the backdrop of extended valuations and generally more restrictive (certainly not expansive) Federal Reserve monetary and rate policy. Most simply focus on the ‘formal’ Fed Funds rate and neglect to take a more worldly view of how ‘relative’ Dollar weakness attracts so much foreign capital to the USA; and hence allows the Fed to work-off a lot of their paper without having to pay-up ‘officially’ to get that done. So we can grade every little Auction (superb A+ early this week; C+ today); and it really doesn’t mean too much.

The trend is snugging-up; the question is simply at what domestic pace; and when one steps-away from a myopic US-only perspective; how the Europeans, Japanese and Chinese funds flow here; as well as whether or not they ultimately take defensive actions to keep funds at home.

Leave A Comment