While some would want to believe in a long summer of lethargy, last week proved the end of such thinking. Inactivity was replaced by hope, greed replaced fear in emerging markets and lack of bigger news allowed for the last big week of summer to end positively after a long painful four weeks of weakness driven by pessimism and doubt.

The rise of oil prices, the reversal of the stronger USD, rebounds in foreign shares, ongoing gains in US equities with new record highs and the drop of US bond yields were all notable last week and beg explanation. We have returned to a Spring time renewal just at the pick of the Summer harvest. The mix of Trump impeachment risks rising and the flexible approach from FOMC Chair Powell on rate policy into the futures drove price action.

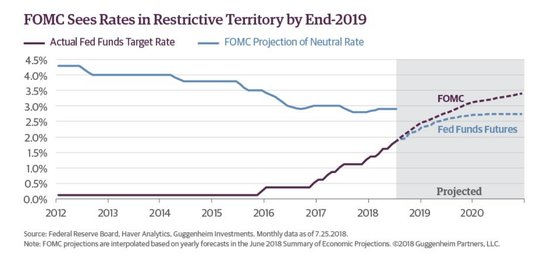

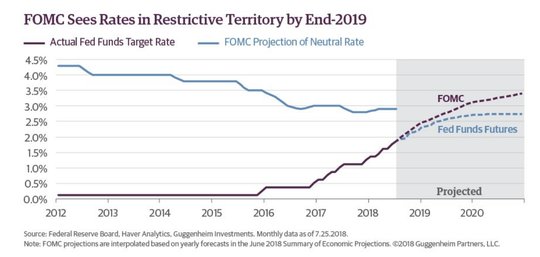

Trump and US politics shifted with Manafort and Cohen driving the focus to the US midterm elections and control of Congress and that in turn added to the USD woes. On the central banking front, minutes from the FOMC were clear. No one doubts the Fed hikes in September and likely again in December, the complications after that are significant.

The USD retreated on Powell after his Jackson Hole comments, where he sees the Fed navigate between twin risks — moving too quickly and needlessly shortening the economic expansion, and conversely lifting rates too slowly and risking a “destabilizing overheating.”

“I see the current path of gradually raising interest rates as the approach to taking seriously both of these risks,” Mr Powell said. “While inflation has recently moved up near 2%, we have seen no clear sign of an acceleration above 2%, and there does not seem to be an elevated risk of overheating.” Powell deliberately said he was avoiding all foreign and political questions, admitting that these were risk factors that “could demand a different policy response, but today I will step back from them.”The market odds for just one rate hike in 2019 are now just 60% which contrasts sharply with the FOMC seeing three hikes.

Nevertheless, for many, the risk of a policy mistake from the Fed remains in play as they watch the shape of the US yield curve and await a recession.

Understanding the Powell Fed reaction function to the economic data and financial conditions is still a work in progress but last week took heart that a complicated outlook means a Fed more likely to wait as the EM noise, stronger US deflationary pass-through and weaker economic data globally linked to trade fears and weather battle against US fiscal stimulus, deregulation and robust corporate profits.

Many want to believe in fairy tales still – not-too-hot, not-too-cold – where returns from passive beat active, where risk-parity rebounds, where bull market trends return robustly and where growth beats value. Thus it leaves the noise and volatility of 2H2018 to the same old hash tags of worries from 1H2018 – China growth, US trade policy, US politics, US rates, EU politics, EM funding and US relations with Iran, Turkey, Russia and North Korea. The chart of the Salient Risk Parity Index and the Soc Gen CTA index reflects the rebound last week and the pain of 2018 still very much in play. This compares badly to the 7.5% gains in the S&P500 and 15.1% in the NASDAQ year-to-date.

What Happened over the Weekend?

The death of Senator John McCain dominated US headlines. He will be remembered as the Republican leader that relished in joint efforts across party lines. But the most worrying news came Friday. The Trump administration seems to have decided to put China trade deals ahead of North Korea denuclearization.

Trump cancels Pompeo visit to North Korea – cites lack of progress on denuclearization, prioritizes China trade issues

Trump also noted that China is helping less with enforcement of sanctions, putting priority on tariffs over efforts on talks with North Korea. Trump noted: “Additionally, because of our much tougher Trading stance with China, I do not believe they are helping with the process of denuclearization as they once were (despite the UN Sanctions which are in place),” he tweeted, adding that Mr. Pompeo would visit North Korea “in the near future, most likely after our Trading relationship with China is resolved”.

Question for the Week Ahead: What did we learn and not learn from Jackson Hole?

The late August Symposium from the Kansas City Fed is always a sign of changing weather for markets. The myriad of economic papers presented usually has one or two shockers – with the focus on the role of e-commerce as a inflation volatlity driver being this year’s winner. Most market players call this the Amazon effect with the love affair of disruptive technology winning capital investments. The paper from Harvard’s Cavallo warns that one-off shocks from FX, oil and trade wars are going to be far more sensitive because of the shift to online retailing.

“These changes make retail prices more sensitive to aggregate, nationwide shocks, increasing the pass-through of both gas prices and nominal exchange rate fluctuations,” said Alberto Cavallo, an associate professor at Harvard Business School, in a report. “For monetary policy and those interested in inflation dynamics, the implication is that retail prices are becoming less insulated from these common nationwide shocks.”

Leave A Comment