Bond Markets

Let’s begin with this week’s the global bond selloff.

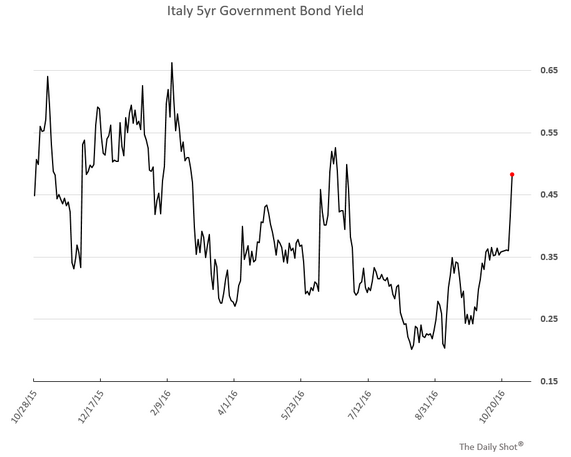

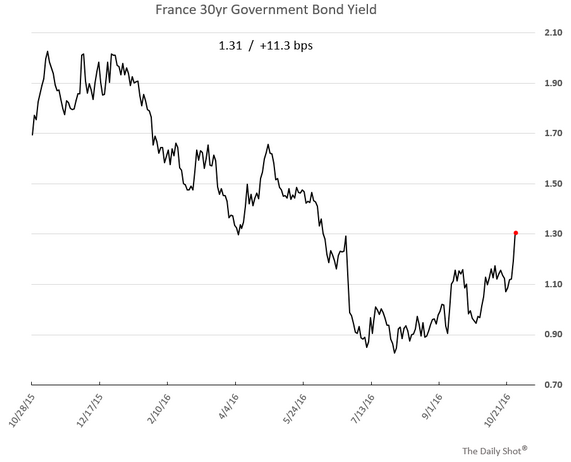

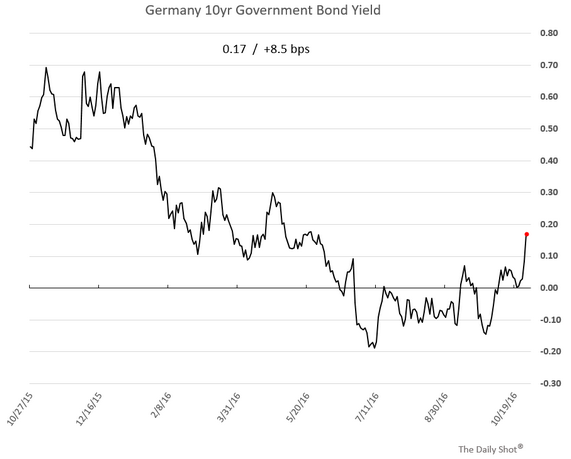

1. We continue to see sharp yield increases in the Eurozone. For example, here is Italy, France, and Germany of varying maturities. Note that the 10yr Bunds are now firmly in positive territory.

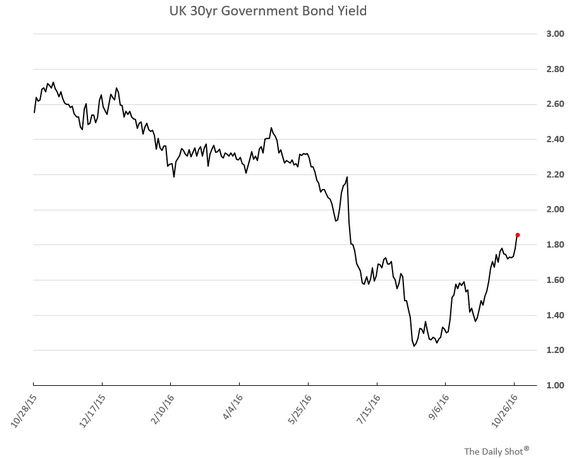

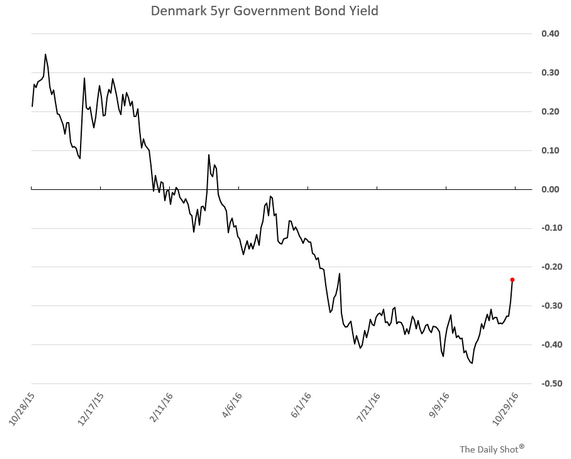

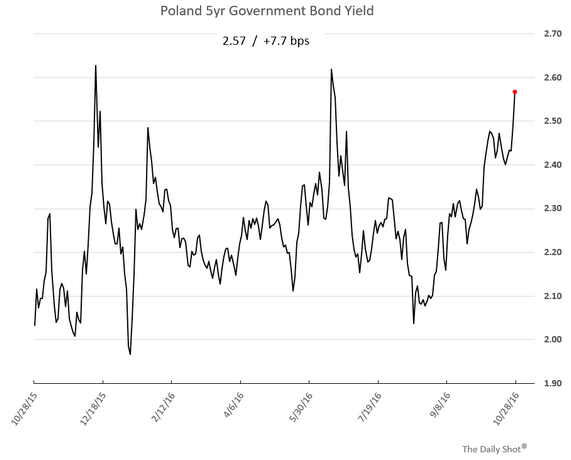

2. Elsewhere in Europe, here are bonds from the UK, Denmark, and Poland.

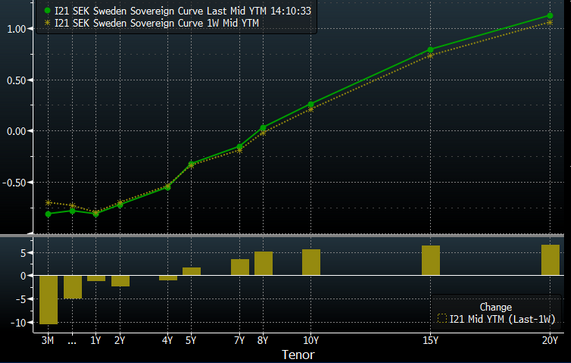

Even in Sweden, where the central bank signaled potential additional QE and “lower for longer” rates (more on this shortly), the yield curve steepened.

Source: Bloomberg

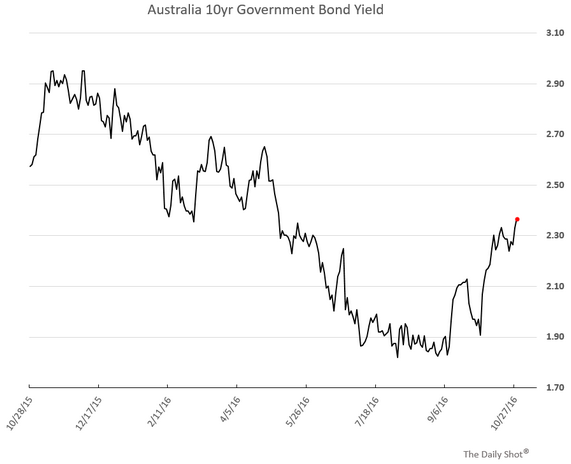

3. Bonds in other parts of the developed world got slammed as well. Here are government debt yields in the US and Australia.

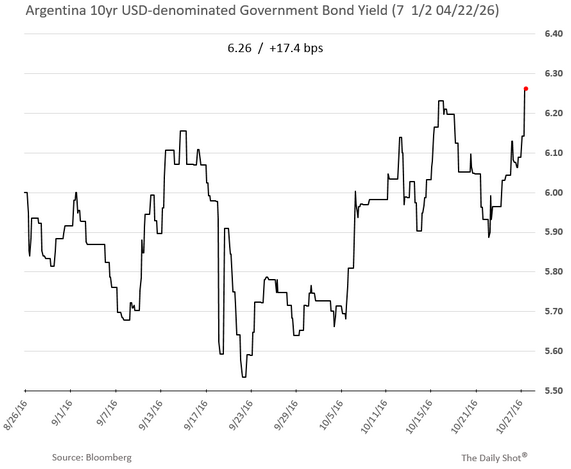

4. Long-term rates also rose in emerging markets. Argentina’s dollar-denominated bond yield rose in part as a result of the overhang (Argentina has sold a lot of bonds since reentering the international debt markets).

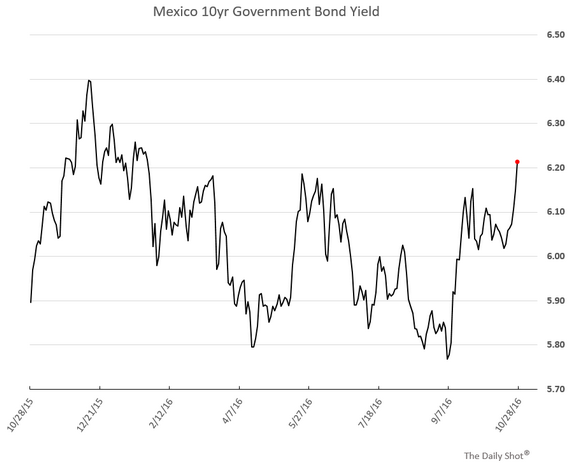

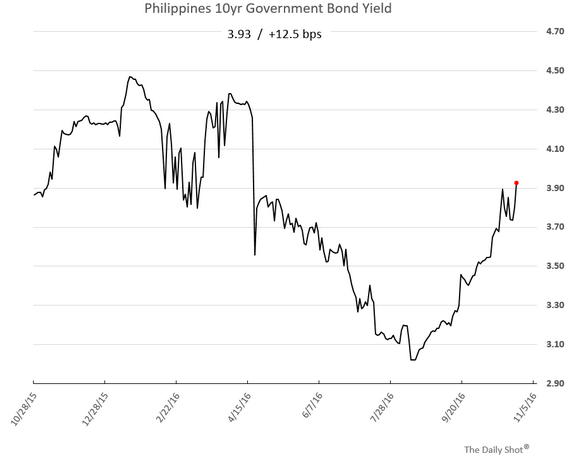

Other examples include Mexico and the Philippines.

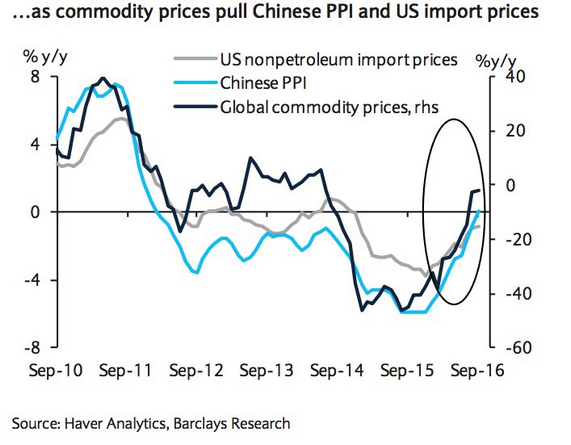

Why this sudden selloff? In part, we have a bit of an overhang of new issuance, triggered initially by Austria’s new 70yr bond as well as sales from Portugal and Germany on the following day. Moreover, there is a now some concern that while markets have been pricing no or negative inflation for years to come, we have signs that the global disinflationary pressures are easing. For example, we’ve seen massive rallies in certain commodity prices, especially metals. As China’s PPI turns positive, the US and other nations’ import prices stop declining.

Source: ?Barclays, @NickatFP, @joshdigga

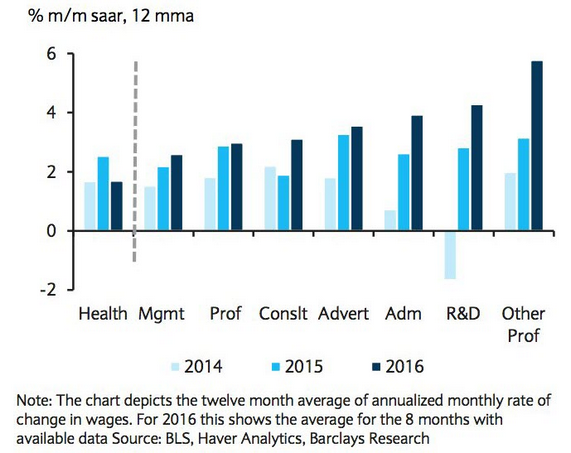

Wage increases in the US represent another sign. Again, we are not talking about any significant inflationary pressures – only somewhat faster price increases than the bond markets have been pricing in.

Source: ?Barclays, @NickatFP, @joshdigga

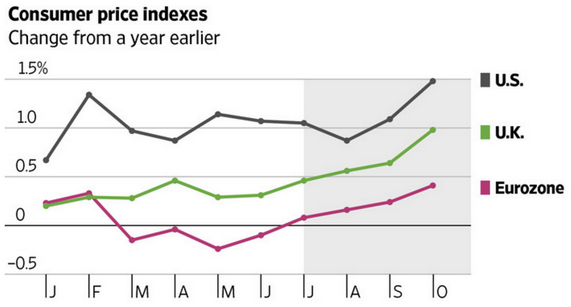

The CPI in some of the large economies has been on the rise, and while the absolute levels are relatively soft, the trends are making some bond investors uneasy.

Source: @WSJ; Read full article

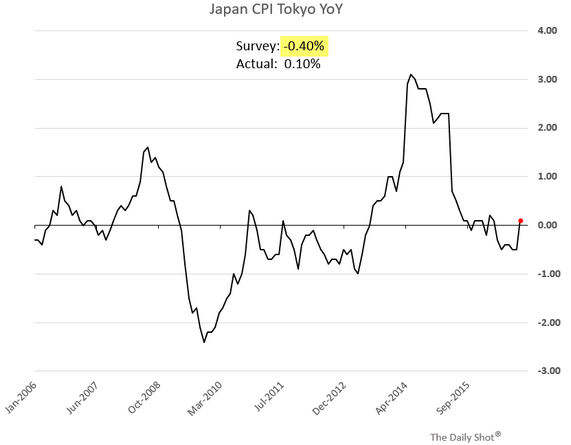

Even inflation figures from Japan this morning were a bit firmer than expected. Here is Tokyo CPI for example (which comes out a month before the national measures).

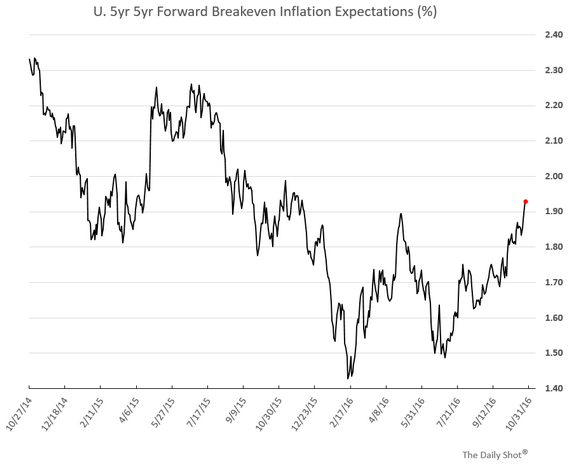

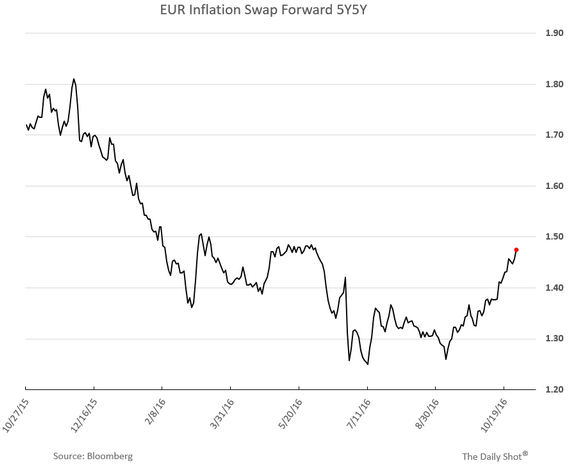

We are also seeing rising inflation expectations in the bond markets. Here are the 5yr, 5yr forward inflation measures for the US and the Eurozone.

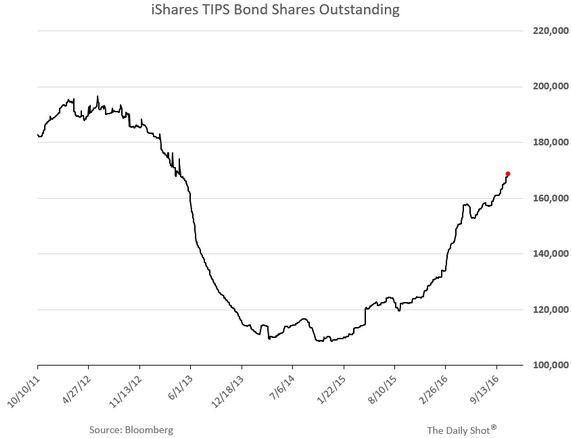

As discussed before, investors’ sentiment on inflation sometimes shows up in fund flows into inflation-linked securities. Shares outstanding in this large TIPS ETF (TIP) , for example, are rising daily.

The world economy isn’t growing fast enough to sustain significant inflation, but given the expectations of “lower for longer,” even small inflation surprises can send bond investors running for cover.

Leave A Comment