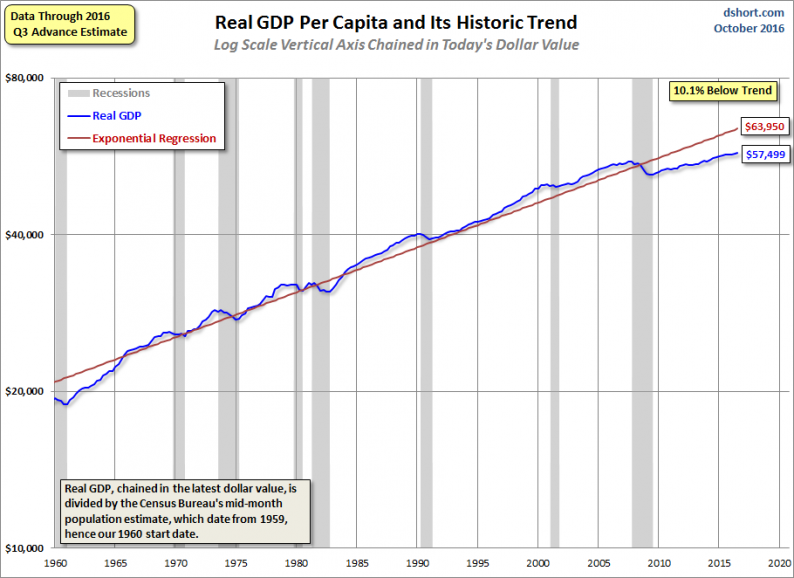

Highlights The Non-Recovery, Recovery The “Great Recession” of 2007-2009 was a huge wake up call. The economy contracted the most since the “Great Depression” of the 1930’s. Unemployment soared. Hundreds of financial institutions failed. But since then the economic recovery

October 28, 2016