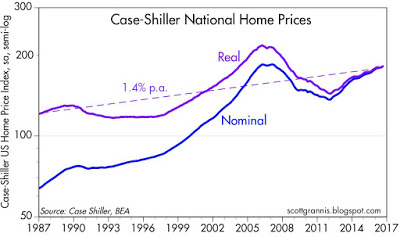

Over long periods, the inflation-adjusted price of homes in the U.S. has tended to increase by a little more than 1% per year. However, this doesn’t mean that owning a home is a good way to make a 1% real

October 28, 2016

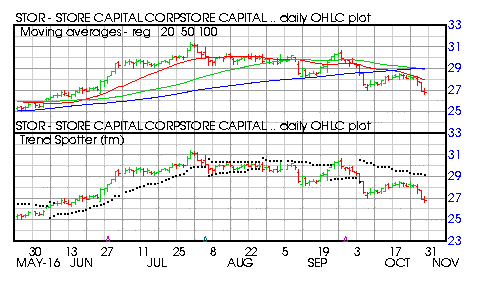

Today I deleted Store Capital (NYSE:STOR), Universal Insurance (NYSEMKT:UVE) and Heritage Commerce (NASDAQ:HTBK) from the Barchart Van Meerten New High portfolio for negative price momentum. Barchart technical indicators: 100% technical sell signals Trend Spotter sell signal Below its 20, 50 and 100 day moving averages 14.93% off its