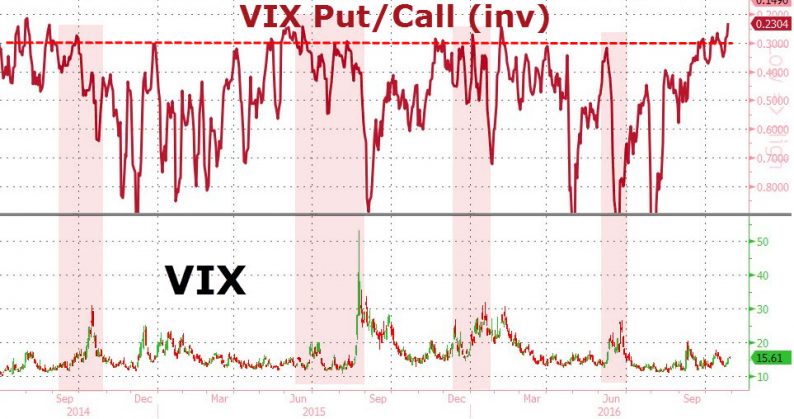

While VIX remains subdued at bull-market-narrative-confirming levels, there are extreme concerns being exhibited in VIX options. There are currently almost 7 times more ‘call’ options (bets on a higher VIX) than ‘put’ options outstanding on the ‘Fear’ index – the highest since August 2015, just days before China devalued and the US equity market crashed.

As the chart below shows, the spikes in VIX Call/Put ratio has tended to successfully lead a spike in VIX a number of times…

And with an election, an FOMC meeting, and a Chinese currency/money market in turmoil again…

Who can blame the professionals from hedging their risk in as sneaky way as possible?

Leave A Comment